Financial Literacy for kids: How to talk to your kids about money?

Hey there, parents! We totally get how important it is to chat with your little ones about money. It might sound like a boring grown-up topic, but it’s crucial to set your kids up for a successful financial future. So, let’s dive into this super comprehensive guide that’ll help you to talk to your kids about money. You gotta drive this. Afterall, you are their parents.

Financial Literacy for kids: The Right Age to Start

Before we get into the nitty-gritty, let’s talk about why this money talk matters. Your kids need to know how to handle it like champs because the real world will not show them how! As they grow up, they’ll face money choices left and right, just like you did. By teaching them the ropes early on, you’re giving them the tools to make smart decisions and avoid money blunders later in life.

You might be wondering when to start the money conversation. Well, no need to wait for the “perfect” time! Even tiny tots can grasp the basics. We’re talking five or six years old here! Start small and keep building up as they grow.

Financial Literacy for kids: Make It Fun and Relatable

Money talk might not sound fun, but trust us, you can jazz it up! Use everyday situations to explain money concepts. Take them grocery shopping and show ’em how to be savvy savers by comparing prices and making smart choices.

Give them a budget, say RM 5 and tell them that they can take anything they want from the shelf, provided it is within the budget. Like my kids, sometimes they try their luck to push their budget boundary to a higher figure given how Jaya Grocer is not that cheap and my answer is pretty consistent whenever wherever, “no, you only have RM 5”. Over time, I noticed they stay within budget.

Financial Literacy for kids: Be Real and Honest

Honesty is the best policy, parents! Be real about your family’s finances. Of course, you don’t need to spill all the beans, but a little transparency

can go a long way. It helps kids understand money responsibilities and priorities.That latest school bag, Nike shoes, PS 5, iPhone 15 Pro Max are what kids these days are used to. Peer pressure is real given how our children are living in a more superficial world – no thanks to early exposure to social media. Instead of

scolding them for being too materialistic, take them back to reality. Show them case studies of what’s happening in countries that can barely have food on the table. Use social media to increase empathy and shift their attention to pressing matters. It takes practise, but it is not impossible.

Financial Literacy for kids: Walk the Talk

Here’s a secret: kids learn from watching their superhero parents! So, be a money role model. Show ’em how you save, budget, invest and spend wisely.

Actions speak louder than words!

Financial Literacy for kids: The Savings Adventure

Teach your kiddos the magic of saving money. Get ’em tabung or a savings account where they can stash their cash. Watching their savings grow is seriously exciting!

Financial Literacy for kids: Wants vs. Needs

This one’s a gem! Teach your little ones about wants and needs. Needs are like must-haves for survival, while wants are those extra goodies we desire but can totally live without. Learning the difference is a superpower!

Financial Literacy for kids: Dream Big, Plan Big

It’s time to talk about setting financial goals. Let ’em dream big and plan big! Whether it’s saving for college or a cool ride, setting goals is a money must-do!

Financial Literacy for kids: Credit and Debt 101

Ah, credit cards and loans or financing – the grown-up stuff! Time to spill the beans on credit and debt. Teach ’em about the ins and outs, and the importance of being responsible borrowers.

Financial Literacy for kids: The World of Investments

Okay, this one’s a bit advanced, but it’s cool! Introduce your children to the thrilling world of investing. Talk stocks, bonds, and mutual funds. Let ’em know it’s a path to building a bright future!

Financial Literacy for kids: Be Prepared – The Money Safety Net

Life’s full of surprises, and some can be expensive! Teach your kids the importance of an emergency fund. Having a financial safety net is like wearing a superhero cape!

Everytime my kids have extra funds either from grandparents, chores, angpau or duit raya, I show them their savings and investment portfolio to show them what compounding means. I remembered when they were younger, they never really cared. But now, they do! They even remember their initial capital invested and it is inspiring to see how interested they are in their own portfolio growth.

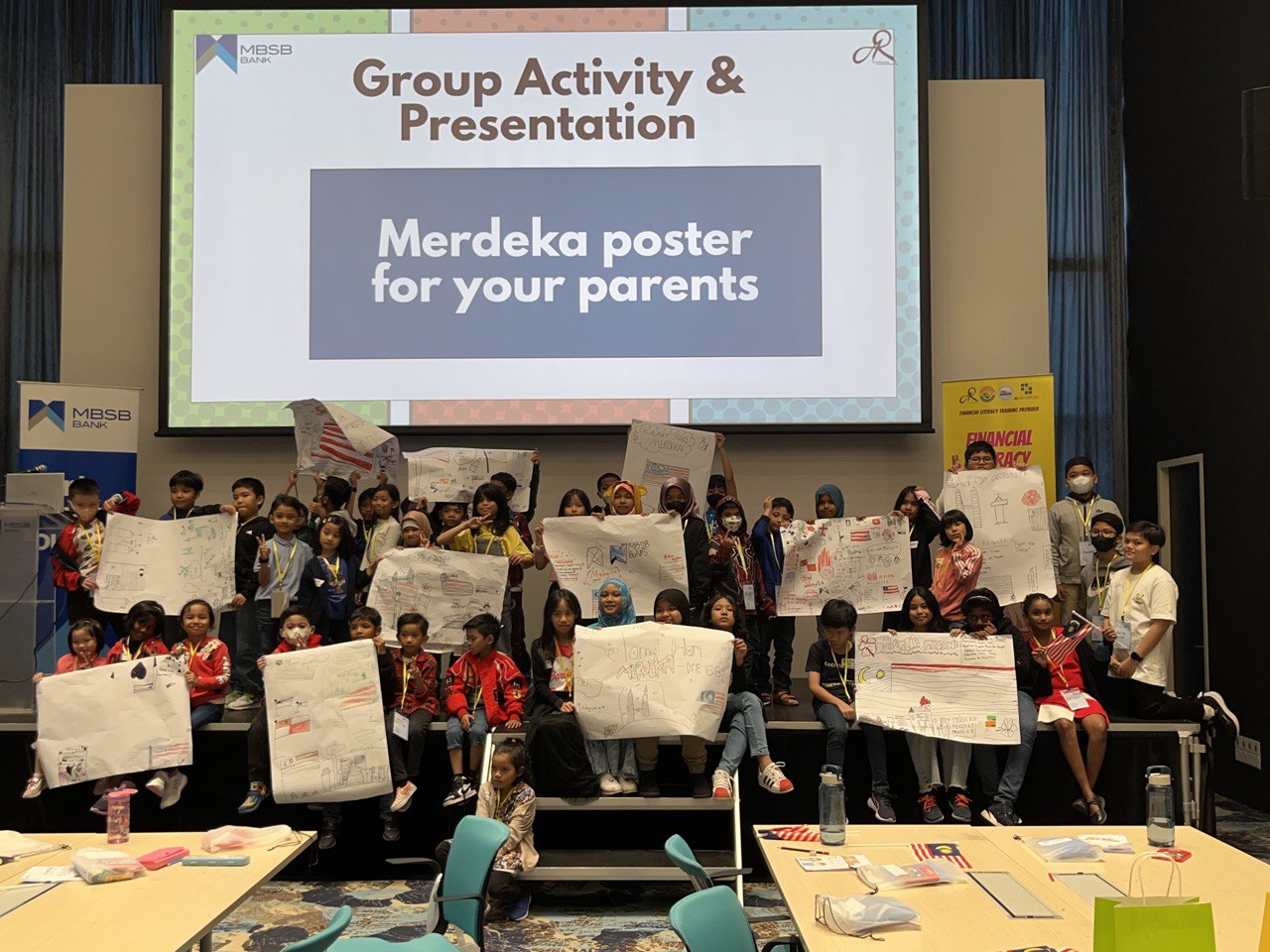

Talking to your kids about money is a journey – a rad adventure you’re embarking on together. Remember, it’s not a one-time chat; it’s a lifelong learning experience. Keep the money convos going and keep being the coolest money mentor! I put my kids on stage to talk about money, simply because I am blessed to have the platform to do so. You may champion something similar in your own loving ways. Remember, it starts with you.

We’re proud to be financial literacy trainers for kids. If you’re interested in learning more about our programs for children, click here to discover more about what we offer.