Is It Too Late to Start Investing in Your 40s? Here’s Why It’s Not!

If you’re in your 40s and wondering whether it’s too late to start investing, the good news is: it’s never too late! Many people believe that investing is something that should have started earlier in life, but the truth is, your 40s can be an ideal time to begin building your financial future. Whether you’re looking to secure your retirement or grow your wealth, your 40s provide a unique opportunity to make meaningful financial decisions that will pay off in the long run.

Why Your 40s Aren’t Too Late for Investing

A common myth is that the earlier you start investing, the better off you’ll be. While starting in your 20s or 30s may give you more time to grow your investments, starting in your 40s is far from being too late. In fact, your 40s might be the perfect time to begin, and here’s why:

1. Greater Financial Stability

One of the major advantages of investing in your 40s is that you are likely in a more stable financial position than in your younger years. By this stage, you may have paid off debt, advanced in your career, and built up some savings. These financial improvements give you more flexibility to focus on long-term goals like retirement, property, or education savings. Instead of living paycheck to paycheck, you now have more resources to begin growing your wealth.

2. Clearer Financial Goals

In your 40s, you likely have a better understanding of what you want to achieve financially. Whether it’s ensuring a comfortable retirement, saving for your children’s education, or building wealth for future generations, you now have more specific goals to aim for. This clarity allows you to create a targeted investment strategy that aligns with your personal objectives, which can lead to more effective financial planning.

3. Catch-Up Contributions for Retirement

If you’re behind on saving for retirement, don’t worry. Once you reach 50, the IRS offers catch-up contributions for retirement plans like 401(k)s and IRAs. This means that you can contribute more than the standard annual limit, helping you make up for any time lost and accelerating your retirement savings.

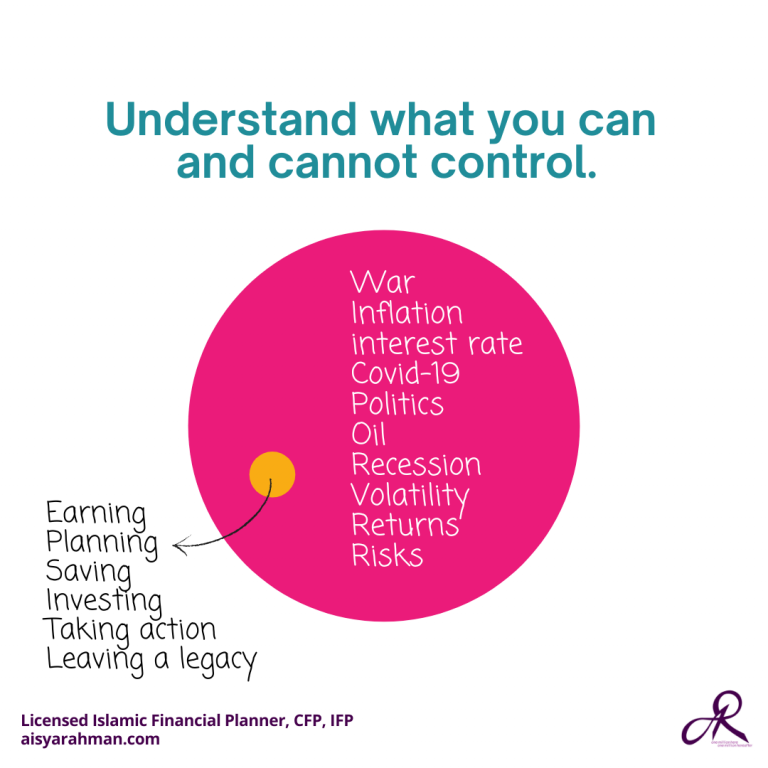

4. You Still Have Time to Recover from Market Ups and Downs

While you may not have the decades to watch your investments grow like someone in their 20s or 30s, you still have plenty of time to see the rewards of your investment. The key is to stay committed and ride through the market’s fluctuations. Even with fewer years to go, long-term investing can still provide meaningful returns if you are disciplined and strategic.

How to Start Investing in Your 40s

Starting an investment journey in your 40s can seem daunting, but it’s actually simpler than it may appear. Here’s a step-by-step guide to help you begin:

1. Start with What You Know

Familiarize yourself with the different Shariah-compliant investment options available to you. In Malaysia, several platforms and products can help you invest in a way that aligns with Islamic principles.

2. Set Clear Financial Goals

To get started with investing, it’s crucial to establish clear financial goals. Do you want to buy a home? Save for retirement? Build up an emergency fund? Once you know what you’re aiming for, you can tailor your investment strategy. For example, if you’re saving for a property in areas like Mont Kiara or Setia Alam, make sure to research the property market and plan your investment around those goals.

3. Start Small and Increase Over Time

You don’t need to make a massive initial investment. In fact, you can start with as little as RM100. The important thing is to start. Over time, you can gradually increase the amount you invest as your financial situation improves. The power of compound interest means that even small contributions can grow significantly over the years.

4. Diversify Your Portfolio

Don’t put all your eggs in one basket. It’s essential to diversify your investments to spread risk. Consider different types of investments, such as stocks, mutual funds, unit trusts, and property. A diverse portfolio helps protect your assets and increases the chances of stable growth, even during uncertain market conditions.

Is It Too Late to Start Investing in Your 40s?

The simple answer is: No! It’s never too late to start investing in your 40s. With a clear plan, the right strategies, and a bit of patience, you can still create a solid financial future for yourself and your loved ones. The key is to start now—don’t wait for the perfect moment because the perfect moment is today!

Financial empowerment starts with knowledge, and at Women & Wealth, we’re here to guide you. Download our eBook now to begin your journey to financial freedom.

For agents, join us for our Women & Wealth Mastery (Agent’s Edition) on 4th February, where we’ll be sharing expert strategies and insights tailored for women like you. It’s time to take charge of your financial future—let’s embark on this journey together!

Reserve your seat at womenwealthworkshop.com.my