EPF Shariah, hands down.

Prior to 2017, Muslim contributors had no choice but to settle for EPF (conventional). Now that we have a choice via EPF Shariah, we ought to hijrah to a platform that is halal and free of riba’. On average, we will work for 30 years (25 to 55 years old). We don’t want our retirement savings to have riba’ in it. Seek for berkat while saving up for retirement.

In terms of difference in dividend, a measly difference of 0.5% between EPF and EPF Shariah can be compensated via withdrawal of EPF Shariah funds into unit trust. Gone are the days where my investors will use forms to thumbprint just to invest in unit trust. Through me, they are able to leverage on EPF Shariah online investing at 0% cost (disclaimer: only for my investors).

Difference in dividend should not be an excuse to not hijrah to what’s halal and what’s right. Remember, Allah is always watching and He knows what’s in our hearts.

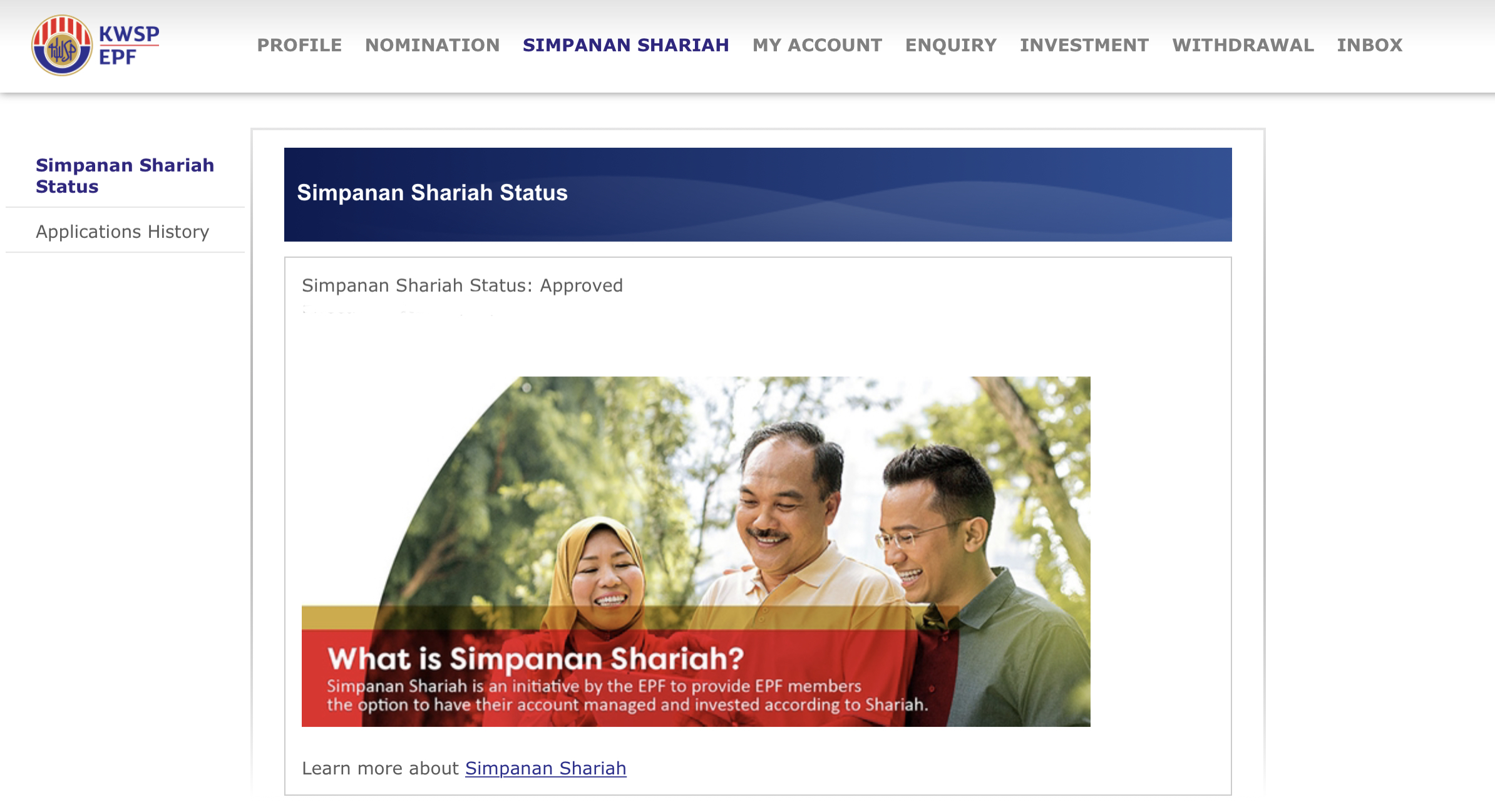

To change to EPF Shariah, all you gotta do is to login to EPF website, and then click on EPF Shariah tab. Voila, you’re done. All the best.

Want to talk to the real Financial Planner? Book for your discovery call.