Hari Raya Aidilfitri is a time of celebrations, family gatherings, and celebration. However, for many Malaysian civil servants, it also comes with financial stress. This year, The National Cooperative Movement of Malaysia Berhad (Angkasa) has revealed a 10% increase in the number of civil servants taking out personal loans ahead of the upcoming Hari Raya celebrations.

While celebrating in style is meaningful, borrowing money for festive expenses can lead to long-term financial consequences. Is the short-term joy of Raya worth the burden of debt?

Let’s take a closer look at why this trend is growing—and how to enjoy the festive season without financial strain.

Why Are Civil Servants Borrowing for Raya?

- The Pressure to Celebrate Grandly

For many Malaysians, Hari Raya isn’t just about celebrating—it’s about looking good while doing it. New baju raya, home makeovers, plenty of food on the table, and giving out duit raya are seen as must-haves.

But let’s be real—the pressure to “show off” is real. Whether it’s family expectations, relatives commenting on your outfit, or scrolling through social media and seeing others go all out, it’s easy to feel like you need to spend more just to keep up.

Many end up swiping their credit cards or taking loans just to have the “perfect” Raya. But is it really worth it if you’re left struggling to pay off debt after the celebrations?

- The Rising Cost of Living

Everything is getting more expensive—groceries, petrol, toll, school fees—you name it. Prices keep going up, but salaries don’t always increase at the same rate. Many families are already struggling to cover daily expenses, so when Hari Raya comes around, finding extra money for new clothes, travel, and open house preparations can be tough.

For civil servants, especially those with lower salaries, saving for Raya is not always possible. When duit raya, baju raya, and balik kampung costs pile up, taking out a loan might seem like the easiest way out. But while it solves the problem now, it can lead to bigger financial stress later.

- Easy Access to Personal Loans

For government employees, getting a personal loan is easy. Many banks and cooperatives offer low-interest loans with easy monthly repayments, making borrowing money feel like a normal thing to do.

Some financial institutions even promote “Raya Special” loans, encouraging people to borrow for new outfits, open houses, or balik kampung expenses. Since the monthly payments seem small, many don’t think twice before signing up. But what seems like a simple solution now can turn into a long-term financial burden after the celebrations are over.

The Real Cost of Borrowing for Raya

Taking a personal loan might seem like a quick fix, but it can leave you struggling financially long after the celebrations are over. Here’s why:

- High Interest & Long-Term Repayment –– Even if the loan has low interest, you’ll end up paying back more than what you borrowed.

- Stuck in a Debt Cycle – Many people who take loans for Raya find themselves borrowing again the next year. This never-ending cycle makes it harder to achieve financial stability.

- Less Money for Your Future – The money you use to pay off loans could have been used for emergency savings, investments, or even retirement planning. Instead of securing your future, you’re stuck paying off past expenses.

Enjoy Raya Without Debt

Celebrating Hari Raya doesn’t have to mean spending beyond your means. Here’s how you can enjoy a meaningful and debt-free Raya:

- Plan Your Raya Budget Early

✔ Start saving months in advance instead of rushing last-minute.

✔ Set aside a fixed amount each month just for Raya expenses.

✔ Prioritise essentials like travel and food over luxury items.

- Celebrate Within Your Means

✔ Affordable but thoughtful gifts are better than expensive ones.

✔ Skip unnecessary spending on over-the-top home decorations.

✔ Cook at home instead of hiring expensive catering—homemade food is always more special!

- Avoid Peer Pressure & Social Media Traps

✔ Just because others are flaunting their celebrations doesn’t mean you have to compete.

✔ True Raya joy comes from family, gratitude, and togetherness—not how much you spend.

- Find Extra Income Instead of Borrowing

✔ Need extra cash? Consider small side hustles like:

- Selling kuih raya or festive hampers.

- Offering cleaning or tailoring services.

- Doing freelance work (design, writing, online tutoring, etc.).

At the end of the day, Raya is about celebrating with your loved ones—not impressing others with your spending. Keep it simple, stay within your means, and enjoy the festivities without financial stress!

Conclusion

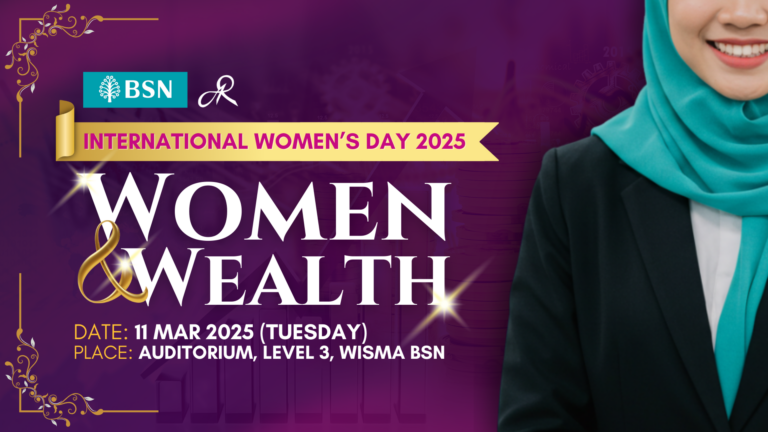

Women face unique financial challenges—longer life expectancy, lower lifetime earnings, and career breaks—making it crucial to save and invest wisely. By understanding these hurdles and taking proactive steps, women can build a strong financial foundation for a comfortable and secure future.

💡 Want to know why financial literacy is essential for women?

Watch our FREE webinar now! womenwealthworkshop.my/women

Ready to take your financial knowledge to the next level?

🔗 Register now at womenwealthworkshop.com.my 🚀

Join our Women & Wealth Masterclass on 10th May at Bentley Music Auditorium, Mutiara Damansara, where you’ll dive deep into all things financial literacy—face-to-face with our expert speaker, Aisya Rahman.

For those seeking guidance on a more profound journey towards financial independence and lasting impact, our eBook, offers strategies to enhance your approach. Turning your wealth into good is not simply an act; it is a commitment. It is a powerful declaration that with wealth comes responsibility, and with compassion comes change.

💡 Don’t wait—start planning your financial future today!