What Are the 5 Money Traps Even Smart Women Fall Into?

Let’s be real — managing money isn’t always easy, even if you’re smart and responsible. Sometimes, no matter how much you know or how hard you work, money can slip through your fingers or make you feel stuck.

If you’ve ever wondered why your finances don’t quite add up, or why saving feels like a struggle, you’re not alone. Even the sharpest women fall into some common money traps without realizing it. Understanding these 5 money traps even smart women fall into is key to taking control of your financial future.

Here are 5 money traps even smart women fall into — and some simple ways to avoid them.

1. The Scarcity Mindset

You know that nagging feeling that there’s never enough money? That fear that you’ll miss out or run out? That’s the scarcity mindset, and it’s a sneaky one.

It makes you buy stuff just because it’s on sale or grab things “just in case.” You might feel anxious every time money leaves your account, even if it’s for bills or something important.

The crazy part? This mindset often makes you spend more, not less — because you’re reacting out of fear, not thinking things through.

How to get past it:

Try to shift your thinking. Track where your money goes, set clear goals, and remember money is a tool, not something to be scared of. When you plan, you feel more in control — and less tempted to buy on impulse.

2. Avoiding Investing Because It Feels Scary

Investing sounds complicated, right? So sometimes we just avoid it altogether. But leaving your money sitting in a savings account that barely grows? That’s a trap too.

Many thinks investing is only for the rich or experts. The truth is, starting small and learning as you go is better than doing nothing.

How to start:

Read up on simple investment options like index funds or retirement accounts. You don’t need to be an expert — just start. Over time, your money will grow, and you’ll get more confident.

3. Saying “Yes” Too Often — Financially Speaking

Women are naturally caring and often say “yes” when family or friends ask for help. But sometimes, this generosity can stretch your budget too thin.

Helping out is great, but if you’re constantly overcommitting financially, it can leave you stressed and short on cash for yourself.

Set boundaries:

Decide how much you can afford to give and stick to it. It’s okay to say no sometimes — taking care of your own financial health means you can be there for others in the long run.

4. No Clear Plan — Just Going with the Flow

Managing daily expenses is one thing. But if you don’t have a plan for your financial future, things can get messy.

No emergency fund, no savings goals, no retirement plan — it’s like driving without a map. You might get lucky, but chances are, unexpected expenses will throw you off course.

Get organised:

Write down your financial goals. Start saving for emergencies — even a small amount helps. Automate your savings if you can. Having a plan makes money less stressful and more manageable.

5. Letting Emotions Run the Show

Money and emotions go hand in hand — sometimes too much. Stress, guilt, pride, or even envy can push you to make decisions that don’t serve you.

Impulse buys when you’re down, avoiding bills because you don’t want to face reality, or spending to “keep up” with friends — these habits are common but harmful.

Pause and reflect:

Before buying, ask yourself: Do I really need this? Am I spending because I feel pressured or emotional? Talking about money openly or even getting support from a coach can help you feel more in control.

Wrapping It Up: 5 Money Traps Even Smart Women Fall Into

Here’s the truth: no one is perfect with money. Even smart, capable women stumble.

The good news is, recognizing these 5 money traps even smart women fall into is the first step to breaking free.

Start small. Track your spending, set one clear goal, learn about investing, and be kind to yourself. Money is a journey, and every little step counts.

If you want more help, look for workshops or masterclasses designed for women — sometimes having guidance and a community makes all the difference.

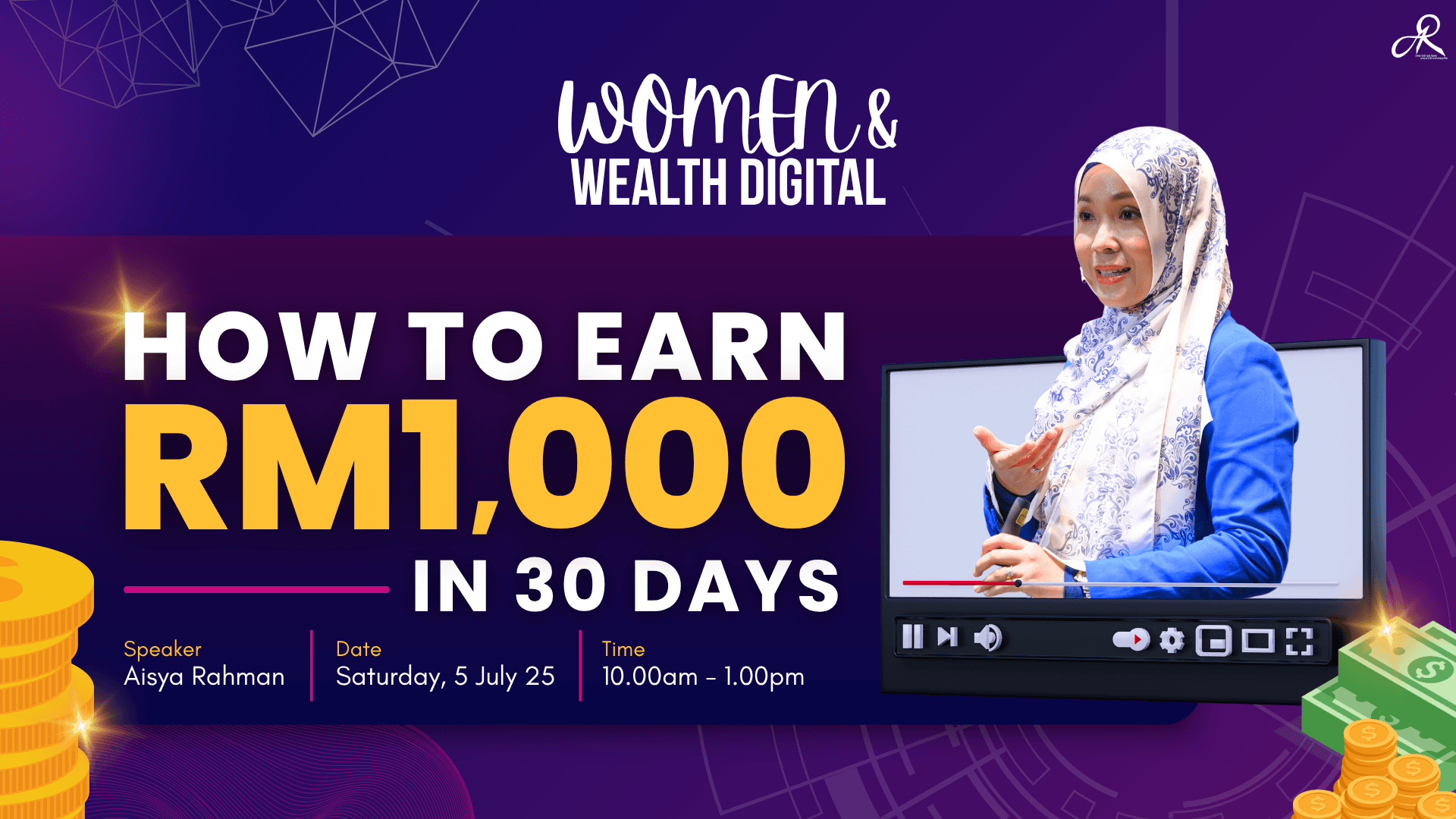

Ready to Take Control of Your Finances and Start Earning Real Income?

If you’ve been feeling stuck in a cycle of financial uncertainty or scarcity, it’s time to change the story.

Join our Women & Wealth Digital Masterclass — a powerful, in-depth webinar designed to teach you how to earn RM1,000 in just 30 days using practical, actionable strategies tailored for women who want real results.

Event Details:

📅 Date: 5 July

⏰ Time: 10 AM – 1 PM

🌐 Reserve your spot now at: womenwealthworkshop.com.my

Spaces are limited, so don’t miss out on this opportunity to learn how to create new income streams and build financial security.

Whether you’re a beginner or looking to level up your current efforts, this masterclass will give you the clarity and confidence to take charge of your money.

For those seeking guidance on a more profound journey towards financial independence and lasting impact, our eBook, offers strategies to enhance your approach. Turning your wealth into good is not simply an act; it is a commitment. It is a powerful declaration that with wealth comes responsibility, and with compassion comes change.