Let’s be honest, money can get complicated, especially when those big bills or special occasions sneak up on us.

You know the feeling: suddenly there’s a huge expense, and you’re scrambling to find cash or wondering if you should swipe your card again.

That’s where a sinking fund can be a total lifesaver. It’s a way to save little by little for planned, known expenses — the things you look forward to or expect — so they don’t hit you like a surprise.

Want to learn how to set one up without feeling overwhelmed? Here are 3 simple tips to help you get started — plus one important thing you need to know about keeping your sinking fund separate from your emergency fund.

Read till the end!

What is a Sinking Fund?

A sinking fund is money you set aside regularly for specific planned expenses you know will come up in the future. Unlike emergency funds which are for sudden and unexpected costs, sinking funds cover expenses you can anticipate and prepare for.

Examples include:

- Raya or holiday celebrations

- School fees and uniforms

- Home repairs or appliance replacements

- Travel plans

- Special purchases or events

By saving ahead, you avoid last-minute stress or having to rely on credit.

Tip 1: Identify Your Expenses and Set Clear Goals

Start by listing all the planned expenses you expect to face in the next year. Be specific and realistic, knowing exactly what you need to save for helps you stay motivated.

Write down the total amount needed and when the payment is due.

For example, if you plan a trip that costs RM1,200 and you have 12 months to save, aim to put aside RM100 each month.

Breaking down big expenses into manageable monthly amounts makes saving less overwhelming and easier to stick to.

Tip 2: Create a Separate Savings Space for Your Sinking Fund

Keep your sinking fund separate from your everyday spending money to avoid temptation.

Open a dedicated savings account or use digital banking tools that let you create sub-accounts or “pockets” for each goal, such as “Raya Gifts” or “Car Service.”

If you prefer cash, you can use labeled envelopes or jars.

The key is to make the money clearly designated for each expense so you don’t accidentally spend it.

Important: Don’t Mix Your Sinking Fund with Your Emergency Fund

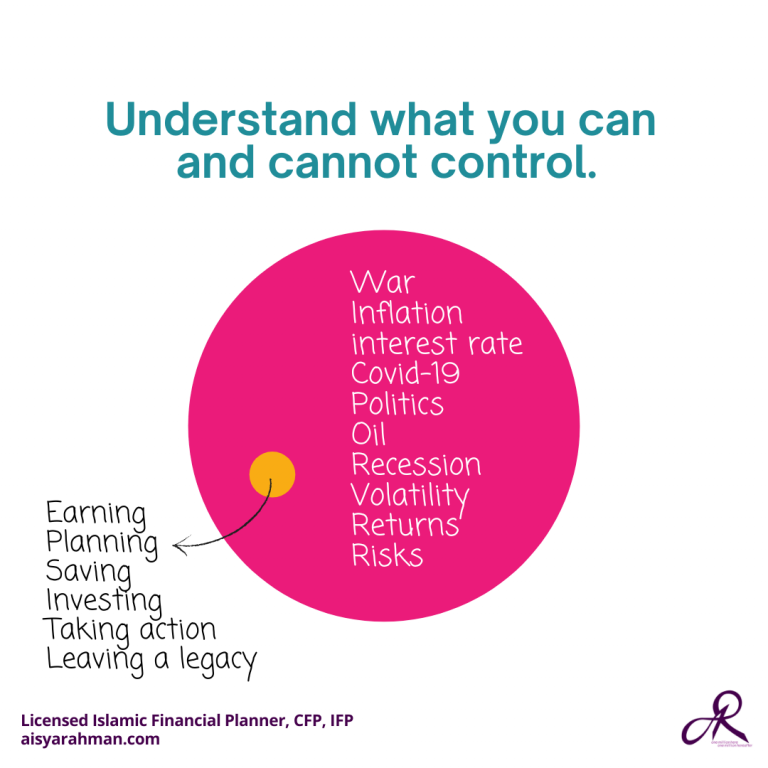

While sinking funds and emergency funds both involve saving, they serve very different purposes and it’s crucial not to combine them.

- Sinking Fund: For planned expenses you know about and can save for gradually.

- Emergency Fund: For unexpected emergencies like medical bills or urgent repairs.

Mixing these funds can leave you unprepared. Using your emergency fund for planned expenses means less money when real emergencies happen. Using sinking fund money for emergencies disrupts your plans and creates financial stress.

Keep these funds in separate accounts or clearly labeled sub-accounts to protect both your plans and your safety net.

Tip 3: Automate Your Savings and Track Your Progress

One of the easiest ways to stick to your sinking fund goals is to automate your savings. Set up monthly transfers from your main account right after payday to your sinking fund account or pockets. This way, saving becomes automatic and less likely to be forgotten.

If automation isn’t possible, set calendar reminders to save a fixed amount each month. Even small, consistent amounts add up over time.

Regularly checking your sinking fund progress every few months is good to make sure you’re on track.

Life changes, and expenses might too, so adjust your savings plan if needed.

Bonus Tips to Make Your Sinking Fund Work

- Prioritise your sinking funds: If you have multiple expenses to save for, focus first on the ones that are due soonest or that would cause the biggest problems if unpaid.

- Group small expenses: Combine smaller costs into one sinking fund category like “Minor Expenses” to make it easier.

- Celebrate milestones: Reward yourself when you reach savings goals to keep motivated even if it’s just a small treat or a personal cheer.

Final Thoughts

A sinking fund might seem like an extra task, but it’s one of the best ways to manage money calmly and avoid last-minute financial stress. By identifying your expenses, keeping your sinking fund separate from your emergency fund, and automating your savings, you’ll be ready for life’s planned costs.

Start small and stay consistent. Over time, this simple habit will bring you peace of mind and stronger financial control.

Come & join our community:

1. Women & Wealth Mastery (Kuala Lumpur Edition)

📅 10 January 2026 (Saturday)

📍 The Bousteador, Mutiara Damansara

⏰ 10 AM – 4 PM

🎟 womenwealthworkshop.com.my

2. Women & Wealth Tour (Melaka Edition)

🗓, 17 January 2026 (Saturday)

📍 Swan Garden Resort, Melaka

⏰ 9:30 AM – 4:00 PM

🎟 womenwealthworkshop.com.my/www170126

Want to Get Started Right Away?

Don’t wait for “someday” to take charge of your finances or your child’s future.

Download our FREE eBook now and start your journey toward financial clarity and purposeful planning today.