Many people save, but don’t invest. Not because they don’t want to, but some just don’t know where to start (no worries, that’s why I’m here – all you got to do is just book for your discovery call here and we’ll get to it during your personalised financial advisory). But for now, read this article first to see if investing is something that you should get into.

Before we get into the highlights of investing, let’s clear the misconception between saving and investing. These are two different techniques altogether. Someone once asked if one could skip saving completely and jump into investing straight away. Once the investments have garnered profits, one could convert the profits into savings for rainy days.

Never. Ever. Do. This.

You must always save first. There is no guarantee that your investments would gain profits. Savings on the other hand is a guaranteed exercise, because the capital is protected should you save it in a capital protected platform. I did a video on it, watch below (but in Bahasa la, k?).

So once you’ve saved, let’s use whatever surplus cash you have to invest.

If I could simplify how investing works, it simply means putting in your money, and forget about it. In between these two, know that your money is being invested in companies that are fundamentally strong (at least this is where my clients and I’s portfolio are invested at) such as Alibaba, Tencent, Facebook, AstraZeneca, Pfizer, Estee Lauder, Johnson and Johnson, Nestle, Lululemon, Under Armour, ExxonMobil, BHP, Hyundai, Midea, LG, Alphabet, Airbus and so much more. These companies have low gearing, cash rich and they are well known brands that are being used globally and daily.

So if you’re worried about your investments could go bust, there’s always that possibility. But before you have such thought, ask yourself: what would it take for all of these companies to go bankrupt at the same time? That sounds like doomsday already.

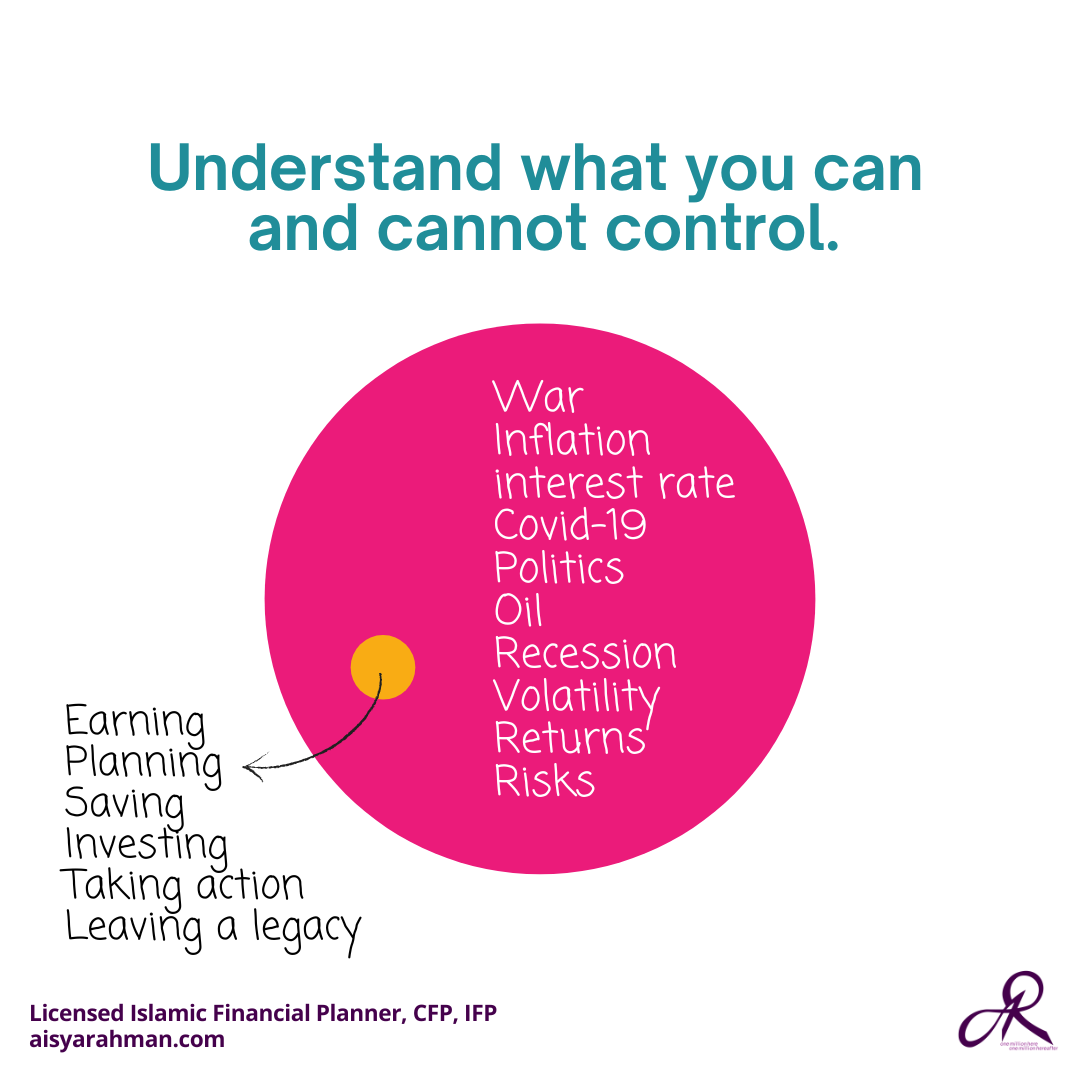

What we can control are the companies that we invest in. What we can’t control are known as external variables, like what’s written in the pink circle below.

Here’s why most people today, especially new investors are anxious about their investments. What I often see is an unrealistic expectation on how one’s portfolio should ‘behave’.

Imagine if you’re investing in the companies that I mentioned earlier. They do not make profits daily (like the company that you’re currently working in right now also lah). Not everyday is a good day. Year-on-year, performance is being assessed to see where revenue falls short, what the external risks are ie: suppliers are increasing their price, banks revising their financing rate hence company has got to service more loan instalments, etc, new hires are costing more, rental hike, fuel hike, everything also hike. This creates a domino reaction to a company’s profit (or loss). This then affects the company’s shares listed in the stock market. This then affects your investments, be it in unit trust, ETF, individual stock picks, robo-advisors such as Wahed Invest, Stashaway (not Shariah compliant), etc because these investments invest in the companies I mentioned.

Investments need time. That’s why I said, the easiest way to understand how investing works is to – pump your money, ensure you invest into the right investments, then forget about it. Come back to it when time is up. General horizon as rule of thumb would be more than 5 years. Even this is too short already, considering the risks that we’re facing today post-covid are aplenty. The longer the horizon the better. Use 10 years as a gauge. Be patient.

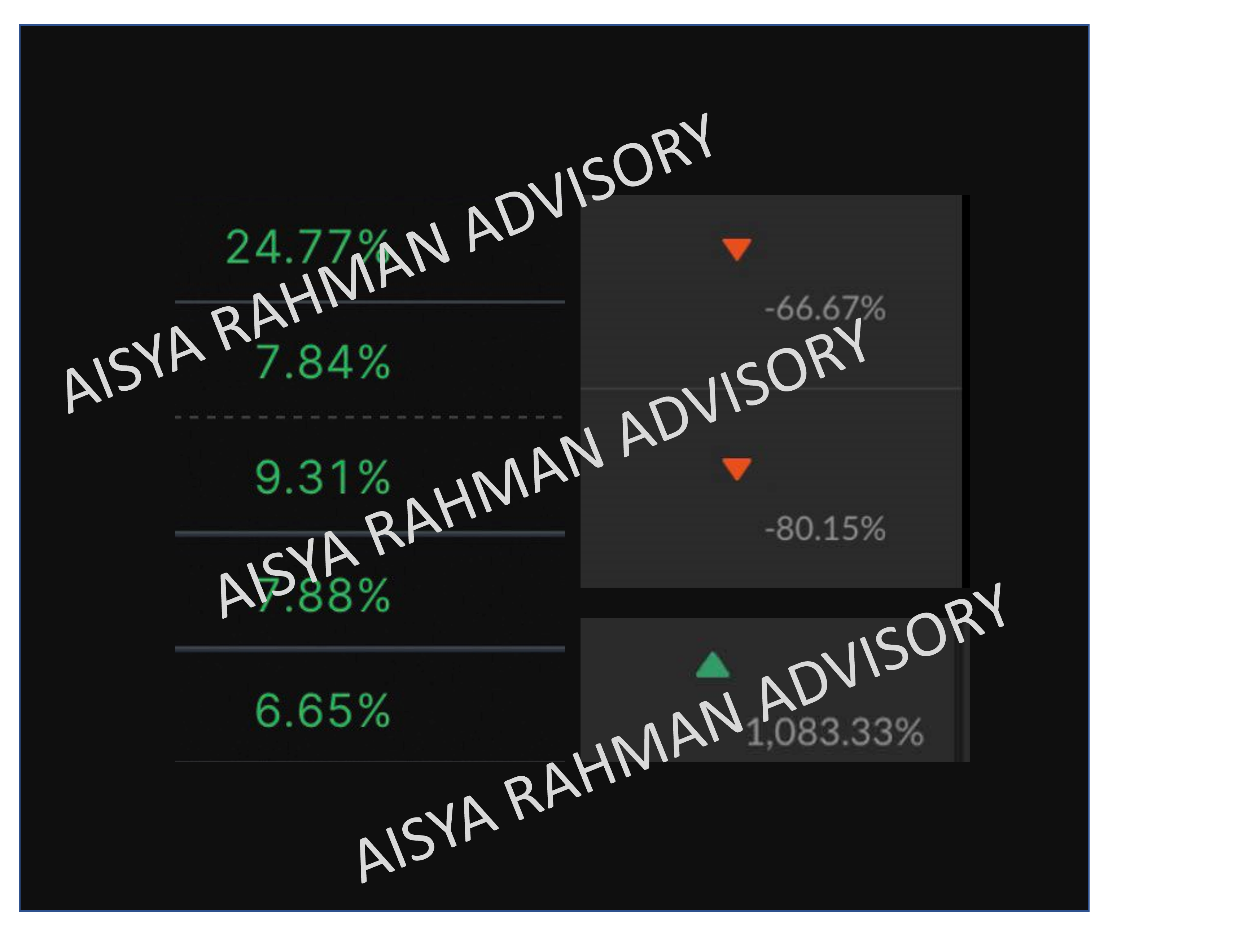

If you’ve gone through the investing lifecycle long enough, you will know that profits are made when the market is good and bad. If you want triple digit returns, you must be okay to accept double digit losses. Investment results come in pairs: the pain and the gain. You can’t just want one and opt out from the other. Like marriage, you can’t just want the good times and skip the bad times. Newsflash: you’re in it for the long haul!

My best result? Four digit returns. My worst? I stopped tracking. Wherever I have invested, be it ETF, crypto, unit trust, stocks, property, I let it flow and grow. I’ve invested long enough to know whatever goes down will eventually come up. I’ve built enough resilience to know the difference between what’s real and what’s not. Most of the time, the fear comes from noise in the newspaper (or Telegram groups, gosh ya’ll can be annoying sometimes).

Tadaaaa! Who says women can’t invest? *flips hijab*

So here’s some investing hacks that I have applied in my life and in my career, which you could apply onto your investing journey:

- Manage your emotions.

- Set realistic expectations.

- Educate yourself with financial literacy.

- Surround yourself with optimistic individuals.

- Set aside sufficient savings, invest the surplus. Let your portfolio grow.

- Have a solid financial plan.

Investing is a lifelong journey, start with investing in yourself first. It’s a one-off investment that generates perpetual returns. Once you start to embrace the investing journey, the ups and downs, trust me, you will continue investing even more, whether rain or shine!

Want to talk to the real Financial Planner? Book for your discovery call.