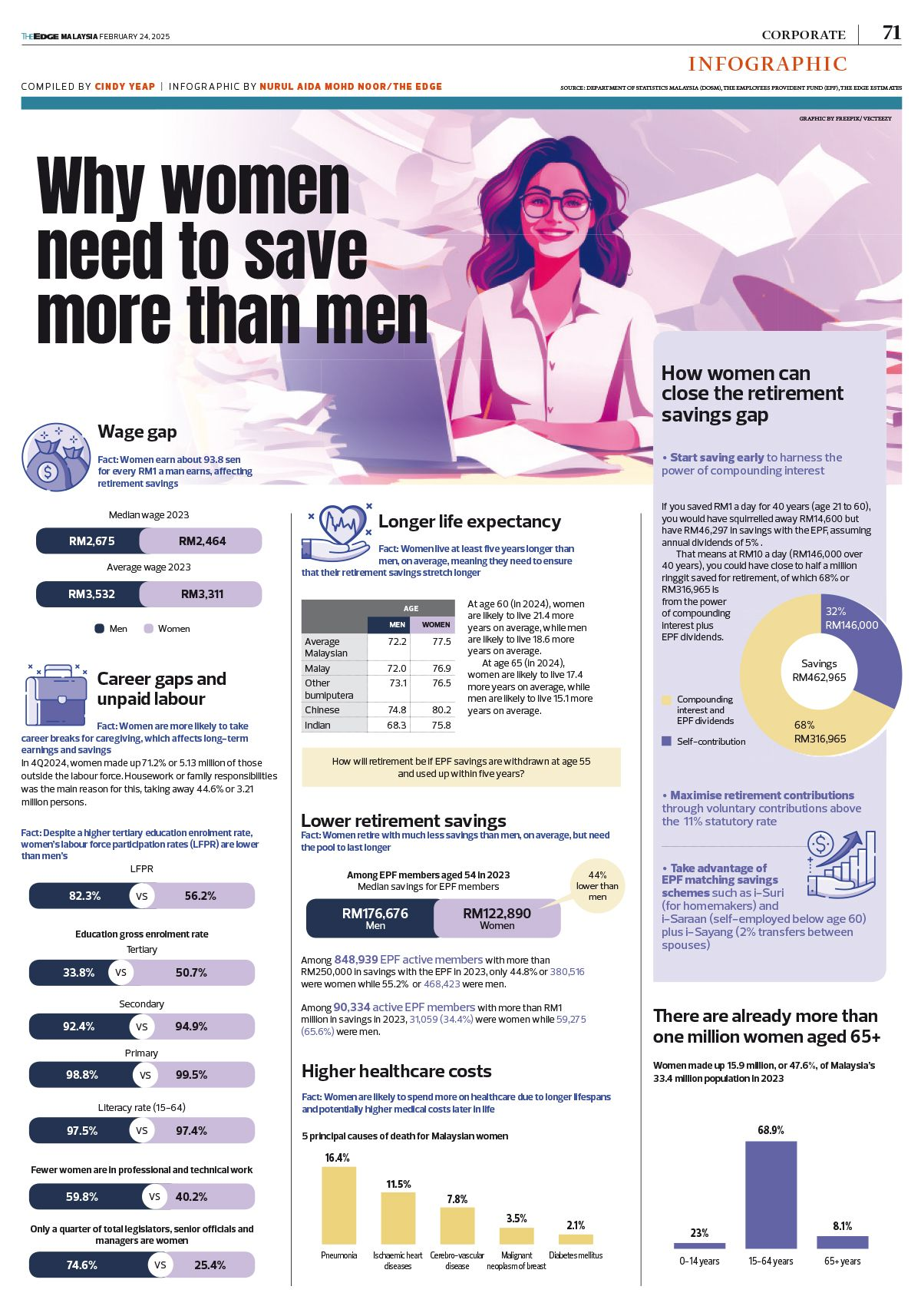

Have you ever wondered why women need to save more money than men? Despite working just as hard, many women find themselves financially disadvantaged due to factors beyond their control. Longer life expectancy, career breaks, and wage disparities put women at a greater risk of financial insecurity.

Without a solid financial plan, many may struggle to maintain their lifestyle in retirement or face unexpected financial burdens. So, how can women overcome these challenges and take control of their financial future? Understanding these issues is the first step toward building long-term financial security.

Here’s why women need to save more than men:

Source: The Edge Malaysia

- Women Live Longer

Did you know? Women, on average, live at least five years longer than men (Source: The Edge Malaysia). That means we need to make our retirement savings last longer.

💡 Have you calculated your retirement age yet? If you rely on EPF alone, will it be enough to sustain you for those extra years? Or will it run out in just five years?

- Income Gap and Pay Disparity

Despite progress, women still earn about 98.3 sen for every RM1 a man earns.(Source: The Edge Malaysia). This wage gap doesn’t just affect income—it impacts retirement savings, investments, and long-term financial security.

With less to contribute over time, women must be more strategic and proactive in financial planning.

The question is: Are you making the right moves to secure your financial future?

- Career Breaks and unpaid labour

Many women take career breaks for caregiving, impacting their long-term earnings and savings. This isn’t just a personal choice—it has real financial consequences. 💰

In 2024, women made up 7.21% of those outside the labor force. With gaps in income, EPF contributions, and investments, the question is: How can we bridge this financial gap?

- Lower Retirement Savings

Women often retire with significantly less savings than men. This is because they are more likely to work part-time or take career breaks, which limits their access to employer-sponsored retirement plans. As a result, they receive lower pension benefits compared to men.

Without consistent contributions to retirement funds, many women risk having inadequate savings for their later years. Additionally, since women tend to live longer than men, they need even more savings to sustain a comfortable retirement.

How Women Can Overcome These Challenges

Women face unique financial challenges, from career breaks to longer life expectancy. But with the right strategy, you can build lasting financial security. Here’s how:

🔹 Start Saving Early – The earlier you begin, the more time your money has to grow through compound interest. Are you making the most of this advantage?

🔹 Invest Wisely – Do you know which investment options can help you achieve higher returns and outpace inflation? Understanding your choices can make all the difference.

🔹 Plan for Career Breaks – Many women take breaks for caregiving, but have you considered how this impacts your long-term finances? A solid financial plan before stepping away from work ensures stability.

🔹 Prioritise Retirement Savings – Even if you’re not working full-time, are you consistently contributing to a personal retirement fund? Small, steady contributions can make a big impact over time.

Conclusion

Women face unique financial challenges—longer life expectancy, lower lifetime earnings, and career breaks—making it crucial to save and invest wisely. By understanding these hurdles and taking proactive steps, women can build a strong financial foundation for a comfortable and secure future.

💡 Want to know why financial literacy is essential for women?

Watch our FREE webinar now! womenwealthworkshop.my/women

Ready to take your financial knowledge to the next level?

🔗 Register now at womenwealthworkshop.com.my 🚀

Join our Women & Wealth Masterclass on 10th May at Bentley Music Auditorium, Mutiara Damansara, where you’ll dive deep into all things financial literacy—face-to-face with our expert speaker, Aisya Rahman.

For those seeking guidance on a more profound journey towards financial independence and lasting impact, our eBook, offers strategies to enhance your approach. Turning your wealth into good is not simply an act; it is a commitment. It is a powerful declaration that with wealth comes responsibility, and with compassion comes change.

💡 Don’t wait—start planning your financial future today!