After 30 years of loyal service, you’ve finally made it.

No more daily jam. No more clocking in. No more boss breathing down your neck.

You’ve earned your retirement — and with it, the pencen you’ve worked hard for.

And yet… something doesn’t feel quite as secure as it should.

You sit down with a calculator. The monthly pencen is decent, yes. But when you start adding up expenses — groceries, bills, medical checkups, petrol, family commitments — the numbers don’t stretch as far as they used to.

And the question creeps in: “Is my pencen enough?”

You’re not alone.

Over the past few years, I’ve met many retired government officers — wise, experienced, disciplined individuals who dedicated their lives to public service.

But the moment we sit down and talk about retirement, I notice the same pattern.

They all thought pencen was the golden ticket. And for a time, it was.

Until real life hit.

The Silent Pressure

You see, most people think retirement means freedom. And in many ways, it does.

But it also comes with a different kind of pressure — the pressure to maintain the lifestyle you’ve worked so hard to build.

- The house needs maintenance.

- Your grandchildren come over more often — and you want to spoil them.

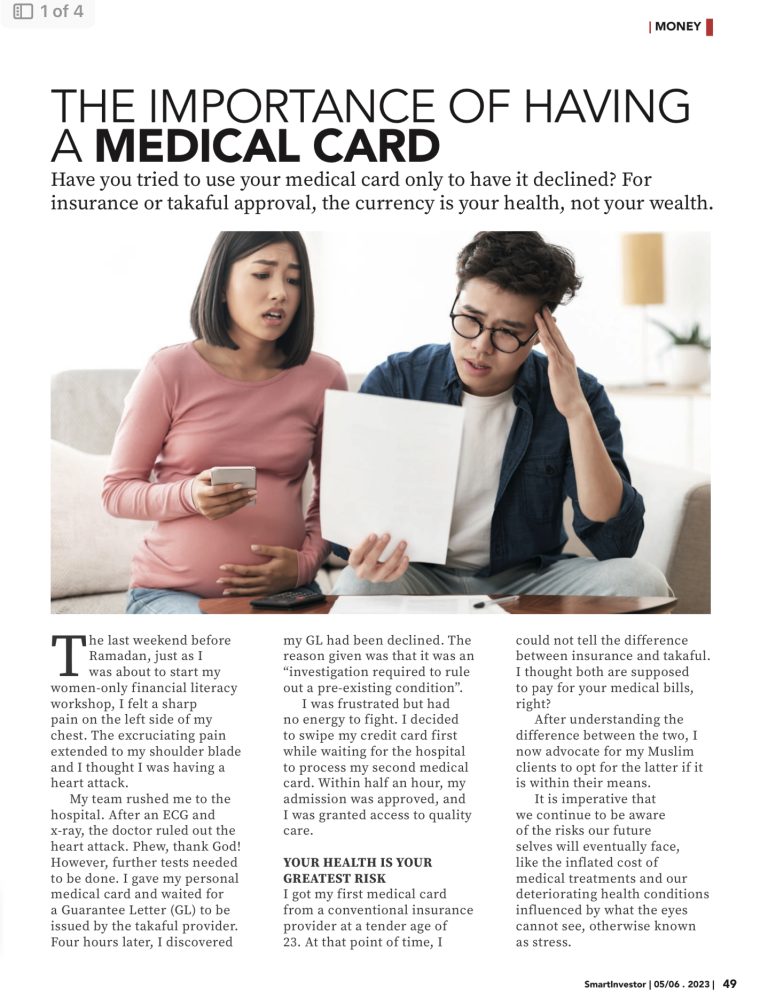

- Your body doesn’t recover like it used to — medical bills rise.

And then there’s the giving.

You’ve always been the strong one. The dependable one. The one your family looks up to. So even in retirement, you’re still giving.

To your kids. To your grandkids. To your siblings.

Sometimes you don’t even think twice before transferring that RM500.

Until one day, you check your account balance and feel that familiar tightness in your chest.

“Am I going to be okay?”

The Pencen Trap

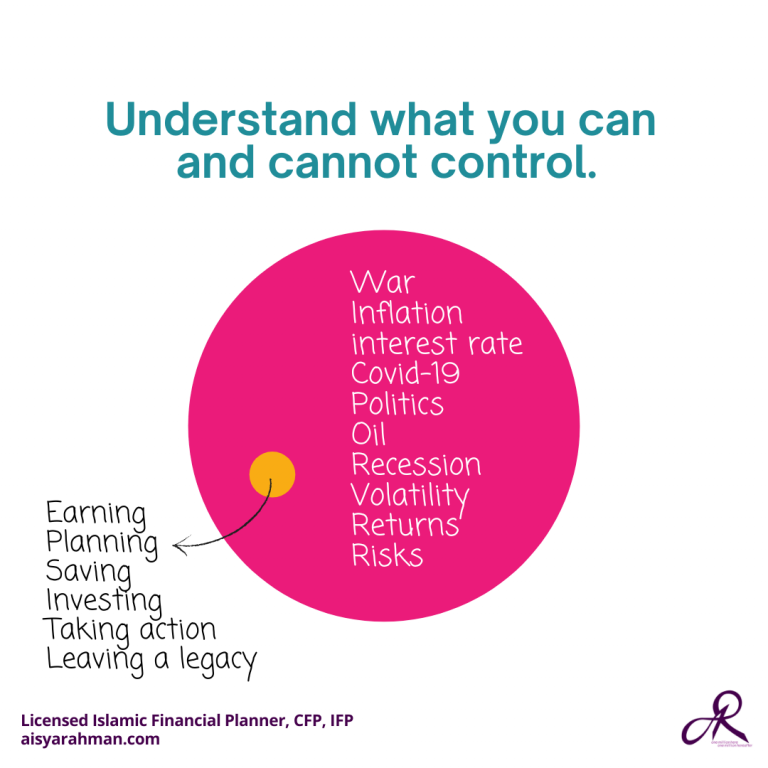

Pencen is a beautiful system — but it’s not designed to grow. It doesn’t adjust itself with inflation. It doesn’t expand when your dreams do. It stays the same. While life… doesn’t.

Many women I meet at this stage of life say: “I thought I was set. But I didn’t realise how fast money moves once you stop earning.”

They didn’t expect the quiet anxiety that comes with watching savings shrink while responsibilities stay the same.

And no one told them that security without strategy can still feel like struggle.

So What Can You Do?

Let me tell you this: You don’t need to go back to work.

You just need a new strategy. Because financial peace isn’t about how much you have. It’s about what you do with it.

It’s about:

- Building income streams that don’t rely on 9-to-5

- Protecting your health and wealth from surprises

- Planning your legacy, not just your lifestyle

- Creating peace of mind that lasts, even in your golden years

You deserve more than just rest — you deserve the chance to rise again, with clarity and confidence.

You’ve worked hard, carried responsibilities, and shown up for everyone around you. Now it’s time to enjoy the fruits of that work without fear or guilt.

You deserve mornings that begin with excitement, not anxiety — and the freedom to give to your loved ones without the quiet worry of running out.

Because true financial security isn’t just about having enough — it’s about feeling safe enough to dream again.

Join us at the Women & Wealth Masterclass — where we help you reclaim peace, power, and purposeful planning for the life you truly want.

Let’s create a retirement plan that doesn’t just pay the bills — but brings you joy, freedom, and dignity.

Grab your tickets at womenwealthworkshop.com.my

For those seeking guidance on a more profound journey towards financial independence and lasting impact, our eBook, offers strategies to enhance your approach. Turning your wealth into good is not simply an act; it is a commitment. It is a powerful declaration that with wealth comes responsibility, and with compassion comes change.

You’ve earned that. And more.