Financial literacy for women

Financial literacy for women

The risks women face in growing our wealth.

In our fast-paced world, women generally juggle multiple roles and responsibilities, leaving no time for self-care and personal development. For some of us, our financial well-being is the price we pay in exchange for not having enough time or support.

Social media has also made us believe that we deserve financial freedom and that living debt- free is the way forward. We have been taught to measure financial freedom tangibly, like owning a certain amount of savings in our accounts or based on how much we earn.

Women live longer than men.

Those who do well in their careers assume they are already financially literate. You may be doing well now while still employed, but can you guarantee the same success in your retirement years?

Studies have shown that women will live longer than men. Today’s employment landscape is a crisis where women do not earn as much as men. This gender wealth gap may hinder women from being financially prepared to live up to 80.

Women empowerment movements are now shifting their attention from gender equality to gender equity to combat the threat women face in longevity. Our clock is ticking, and eventually, we must transition into retirement, whether by choice or force. Are we financially ready?

Women face more vulnerabilities than men.

As women, we become the backbone of our families and communities. We nurture our children, manage household affairs, and generate income from home or our careers. Some of us are also ‘self-made finance ministers’ who coordinate prompt bill repayments and commitments.

When we are so bogged down with our day-to-day, it affects our physical and mental well-being too. This hampers our ability to focus on important, long-term matters such as our own finances, saving for rainy days, planning for our children’s future, ensuring we have enough for retirement, investing, and much more.

We use our exhaustion as an excuse to avoid any money- related conversations – not just with ourselves, but with our spouses too. For some, when the topic of money is raised, instead of brainstorming for solutions, the husband or wife may shut down and become defensive, thus leading to arguments.

If you continue to sweep your financial problems under the carpet, eventually, you will be forced to face these problems head- on. Will you have the financial, mental, and emotional means to handle these problems when you are desperate for solutions? Can you afford to pay the price?

Common sense is not common. So, invest in yourself first.

When I was 21, my mother thought I could benefit from this leadership programme which ran for five months. Little did I know that this journey would become the foundation for my personal growth, igniting a passion for continuous development that still burns brightly within me today.

On the road to achieving financial freedom and becoming financially literate, stepping back and examining how we have been navigating our life is essential. We often do not intentionally review our relationship with money because we think managing money is about having common sense.

Shockingly, common sense is not applied to how we manage and nurture our finances. Some of us tend to use our emotions to decide. Statements like “the market now is bad” or “I am waiting for the right time” are examples of our feelings getting in the way of a better future. Hiding behind our fears will not solve our financial problems, so learn to know those emotions first, because investing in ourselves tends to pay the best ROI.

Women must catch up with investments.

I have also learned that a pretty prospectus and fact sheets are not the best tools to get to a woman’s heart when it comes to encouraging them to invest in financial instruments. There are many layers to peel before a woman can finally be open to investing.

Women can invest. Someone must believe in them first and help them believe in themselves. Isn’t it powerful to be able to call the shots and decide what and where to invest in?

The price of acquiring a peace of mind.

Financial literacy for women

I’d often relate having financial freedom with having peace of mind. Imagine this:

“If I quit my job today, how long can I survive unemployment?”

“If my son needs urgent medical assistance, which pocket can I tap into to pay for immediate care?”

“If my husband passes away today, what financial mess do I have to clean up apart from grieving while looking after my children on my own?“

No matter our situation, money can help us find a suitable cure or help. Thinking about the what ifs will only drain you. You are already exhausted. Financial literacy unlocks the door to peace of mind and empowers us to mitigate uncertainties. Financial literacy results in the capacity to be confident in making financial decisions aligned with your life values and goals.

The power of a like-minded community.

Since the beginning of 2023, I have

hosted private financial literacy workshops for professional women, entrepreneurs, and retirees. It made me realise how women actively seek a safe space to connect with other women and reconnect with themselves.

To disrupt your comfort zone, you must put yourself in unfamiliar territory. Slowly, the unknown becomes familiar. Engaging in a supportive community of like- minded women can provide invaluable engagement, guidance, and accountability on our financial journey. You become like the top five people you spend time with, so choose your circle wisely.

Financial education is a lifelong journey.

Financial literacy for women

Financial literacy is not just about numbers and spreadsheets. It is about empowerment and peace of mind. Stay curious and continuously seek opportunities to expand your knowledge. It is time to rise above our vulnerabilities and embrace our power to create financial abundance.

You and I can rewrite our narratives and unlock a life of freedom, security, and fulfilment. Imagine the powerful legacy we can leave behind for future generations by equipping them with the knowledge and skills needed to combat the financial landscape with confidence. Don’t you want to be the cycle breaker in your lineage?

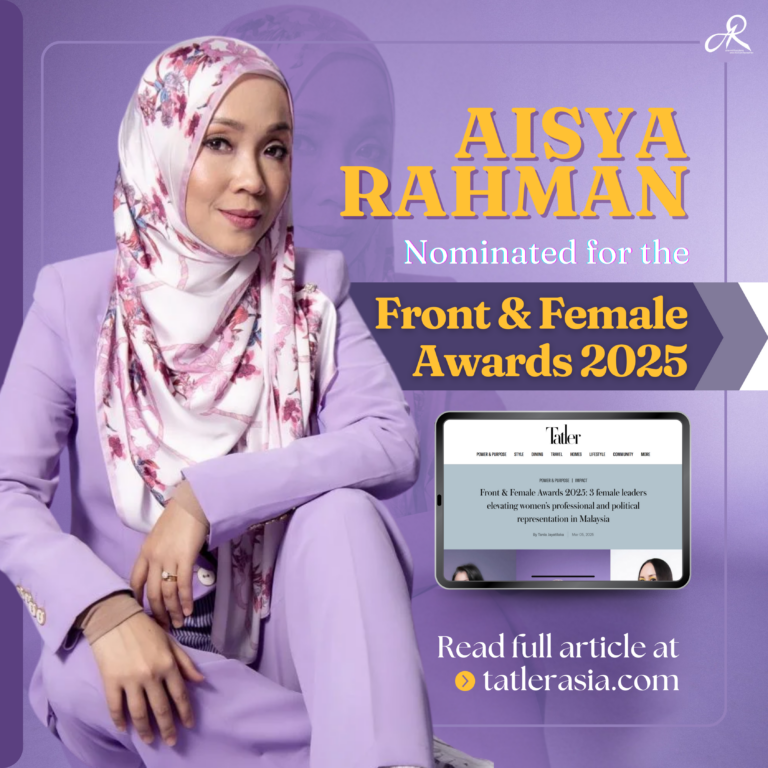

This article was written by Aisya Rahman and published in Smart Investor’s magazine, March to April 2023 publication. Aisya is an Approved Financial Adviser from Harveston Financial Group and an HRD Corp Registered Training Provider. She is passionate about empowering women through Islamic financial planning on her Instagram @aisyarahman.advisory.