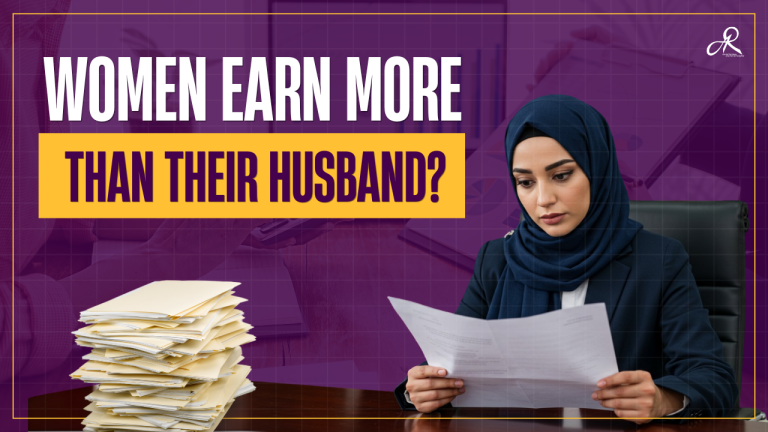

Well, since I am a Licensed Financial Planner and Licensed Islamic Financial Planner myself, the answer is heck yes. This article tells you why.

However, if you ask someone who’s been burnt by a “Financial Planner” – and I say this with sarcasm because there are way too many unit trust, insurance and takaful agents out there positioning themselves as Financial Planners, then likely these segment would say no.

To undo the misconception (or damage?), and for you to have a better understanding on whether you should proceed with engaging a Licensed Financial Planner, read til the the very end.

Financial Planners do not ask you to buy a product immediately

If you meet person A and he / she asked you to buy an insurance investment plan or invest in unit trust during the first meeting, likely these folks are insurance / takaful / unit trust agents.

At all times, a Financial Planner wouldn’t ask you to buy a product on the first, second and third meeting.

For me, I’ll invest time in getting to know you first, your financial situation, your dreams and aspirations, understanding your money habits to dig beyond the surface and much more. By gathering all these information, this is where I am able to pin point your personal finance to you before you make any financial decisions like investing, getting a new medical plan, developing a will etc. Execution is always the last thing we’ll carry out.

Financial Adviser and Financial Planner are regulated titles / designations

Anyone taking up CFP / IFP are not Financial Planners. This is just paper qualification. Read my past article here to understand the process of upgrading oneself to become a Financial Planner.

Ever wondered why there are only 1,300 Financial Planners in Malaysia? You think easy meh..

Anyone can learn CFP / IFP but practising it professionally is an entirely different level and brings with it huge responsibility.

Financial Planners can offer you products from different providers

This was one of the reasons why I was influenced to upgrade myself from just a unit trust agent to a Financial Planner. I loved the fact that I could dissect all funds, all insurance and takaful products in Malaysia without the need to be bias to a single provider.

I loved that my clients could know what’s available out there, what their strengths and costs are before finally deciding on which solutions to go with.

This is something that agents can never do because they are tied to a single provider. One would say Prudential is the best, AIA is the best, Great Eastern is the best. Ask me on which insurance and takaful is the best = my answer is.. there’s no best plan, the best one is the one that wants to cover you right now. We compromise based on our health conditions and needs. Eventhough money is important, if your health conditions is not at an optimum level, no provider would want to cover you.

As a Financial Planner, I have access to the big players in insurance and takaful. With this, I could identify which provider is the best for certain type of coverage, which one you can skip, etc.

Financial Planners are not free

I don’t respond to people asking for free advisory.

You want proper, structured, real answers? Pay for advisory.

We are able to answer your questions and dilemmas, propose the right solutions in a reasonable time frame because we ourselves have invested time, money and energy to continuously upskill and learn where and what to invest, analyse the available insurance and takaful products in the market (they change all the time!), understand tax and zakat, keep up with regulations and laws, and our commitment to continuous learning is endless. The market is evolving on a daily basis.

So for anyone who feels that Financial Planners’ ‘lip service’ should be free, even ais kosong is 50 cents bro and sis…

Financial Planners are ‘atas’

When I say atas, I am referring to people like you and I who take our personal finance journey seriously. Sure, you’ve explored DIY-ing your money management yet nothing seems to budge. Or you’ve explored StashAway, Wahed Invest, and many other form of robo-advisory, yet you invest with no clear direction on where you’re heading – some don’t even understand what these investments invest in (!!!!). These are signs that you need to atas-ify the next part of your life by engaging a Financial Planner.

Treasure your time. Simplify your strategy by engaging a Licensed Financial Planner. Use the remainder of your time on other useful things such as business expansion, upgrading your knowledge and even spending time with your loved ones.

Lastly, to conclude, Financial Planners won’t be able to make you wealthy. However, Financial Planners can be someone you leverage on as a tool for you to reach financial independence. In order to reach this stage, you got to know what your options are, where are your limitations, how to turn these limitations into your strength and much more.

Look at this engagement as an initial investment. It saves you time. Time is money. You’ll end up saving more in the long run. Remember, you’re your greatest investment. You’re also your greatest risk. Trade on both ends wisely.

Want to talk to the real Financial Planner? Book for your discovery call today.