When it comes to financial success, saving vs. Growing: What Women Must Learn Early is more than a catchy phrase — it’s a mindset shift. For decades, women have been told to save.

Save from what’s left. Save for emergencies. Save quietly.

But saving alone isn’t enough anymore.

To build real wealth, women need to understand Saving vs. Growing: What Women Must Learn Early in their financial journey — and the sooner, the better.

Saving vs Growing: What Women Must Learn Early in Today’s Economy

In the past, saving felt like the responsible thing to do. And it still is.

But Saving vs. Growing: What Women Must Learn Early is that saving protects while growing multiplies.

Without growth, money sits idle, losing value to inflation.

Many women are good savers but hesitate when it comes to growth.

That’s why the conversation around Saving vs. Growing: What Women Must Learn Early is so important for every woman — whether she’s a student, mother, employee, or entrepreneur.

Growth: The Missing Piece in Women’s Financial Journeys

Growth, on the other hand, is where wealth is built.

Growing money means taking the money saved and putting it to work — so it starts earning more on its own. This could look like:

-

Learning how to start a side income

-

Selling digital products or services

-

Investing in knowledge or digital tools

-

Putting money into long-term assets or funds

The biggest difference?

Saving protects what’s earned.

Growing expands what’s possible.

The Fear of Risk and Why It Holds Women Back

Many women avoid growth because of one word: risk.

The thought of losing money, making a wrong decision, or stepping into something unfamiliar creates anxiety. This is especially true for women who are the sole or primary earners in their households. When there’s no safety net, even small risks feel huge.

But here’s the truth: There is also risk in doing nothing.

Not growing money is a risk.

Relying only on savings is a risk.

Postponing financial education is a risk.

The longer women delay learning how to grow, the harder it becomes to catch up later in life.

Learning to Grow Doesn’t Mean Investing Thousands

One common myth is that financial growth requires big capital or deep expertise. But in today’s digital world, that’s no longer true.

Women can now:

-

Start a digital side hustle with less than RM100

-

Learn income skills like writing, editing, or design online

-

Promote products as an affiliate and earn commission

-

Create and sell their own knowledge as digital content

-

Offer services on freelance platforms with zero setup cost

These are not fantasies. These are real, accessible paths being used by everyday women — mothers, students, caretakers, employees — to start building beyond just savings.

The Emotion Behind the Numbers

This isn’t just about numbers in a bank account.

It’s about freedom, security, and self-worth.

-

When a woman grows her money, she has more choices.

-

When she earns beyond her salary, she creates room to breathe.

-

When she sees her income rise, she sees her value in a new light.

Money is not the goal — what money allows is the goal. And that’s why the shift from saving-only to saving-and-growing is so important.

Start Small, But Start Smart

The transition from saver to grower doesn’t have to be dramatic. It can begin with small steps:

-

Learning how digital income works

-

Understanding personal cash flow

-

Setting aside RM100 not just to save, but to test and try something new

-

Building confidence through low-risk digital strategies

These small wins compound. With time, they build a different kind of mindset: not one of fear, but of possibility.

A New Way Forward

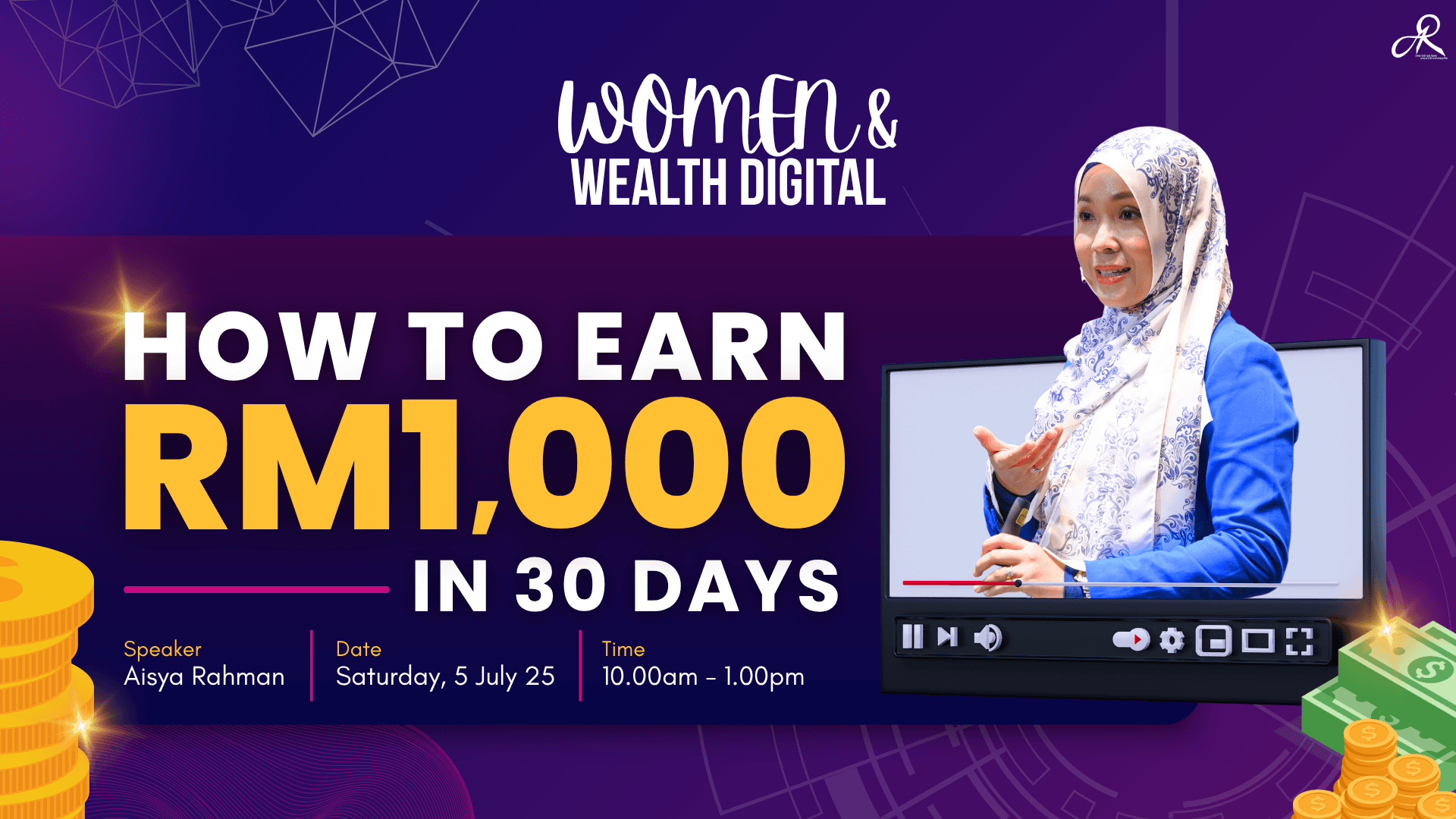

The Women & Wealth Digital Masterclass was designed with this exact mission in mind — to guide women in taking control of their money journey by learning how to grow, not just save.

For women who are tired of feeling stuck, unsure, or behind, this is the first step toward something better.

Join our Women & Wealth Digital Masterclass: How to Earn RM1,000 in 30 Days on 5 July 2025, 10 AM – 1 PM.

Secure your seat now at womenwealthworkshop.com.my and start your journey to financial confidence and growth!

For those seeking guidance on a more profound journey towards financial independence and lasting impact, our eBook, offers strategies to enhance your approach. Turning your wealth into good is not simply an act; it is a commitment. It is a powerful declaration that with wealth comes responsibility, and with compassion comes change.