FINANCIAL LITERACY CORPORATE TRAINING AND SPEAKER

Does this sound familiar?

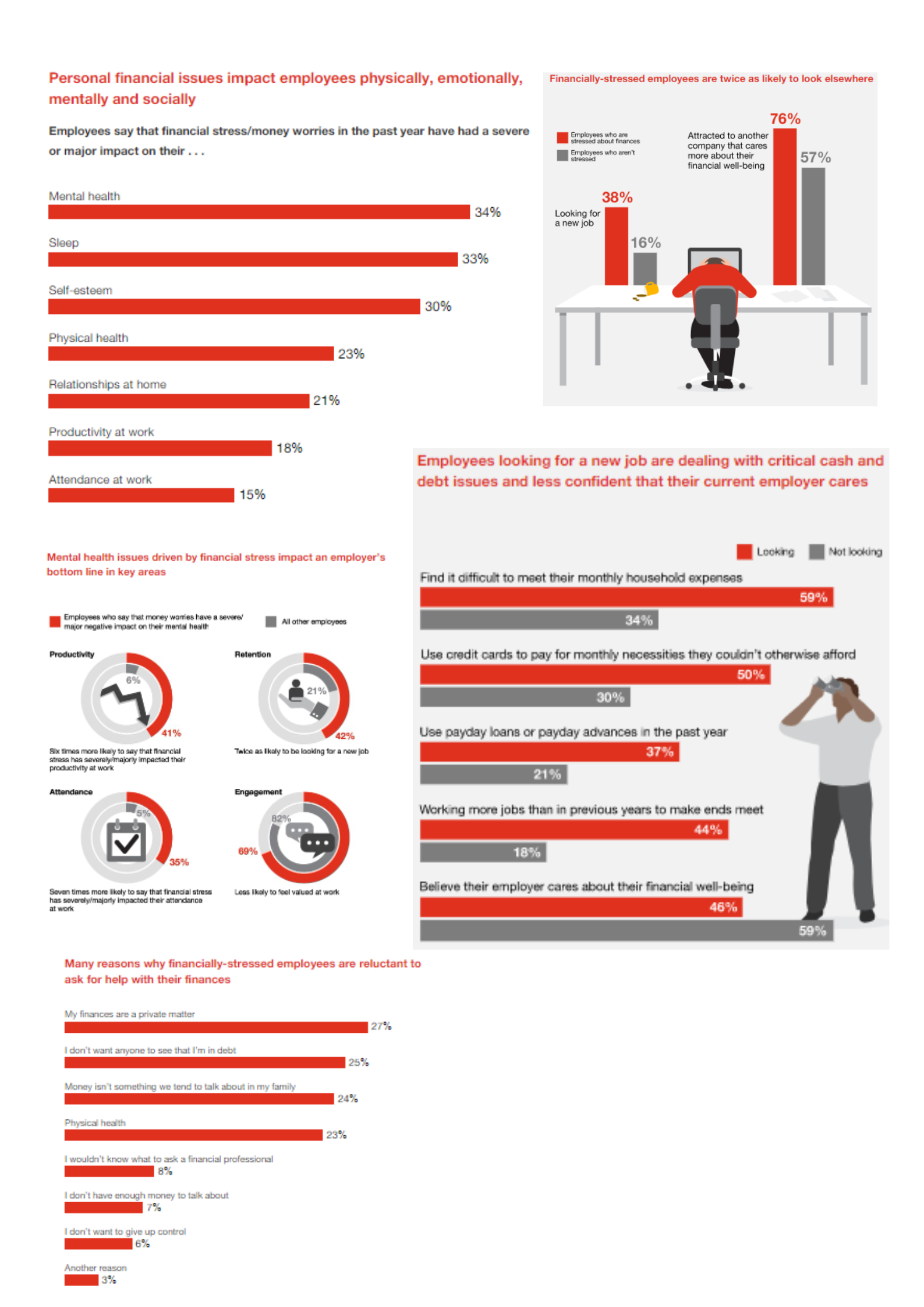

- Your employees are stressed about finances, impacting productivity and morale.

- You see rising absenteeism due to financial worries and debt.

- Employee turnover is high, often driven by financial concerns.

- Engagement is stagnant, and you struggle to attract top talent.

Employees work at least 8 hours a day. Why not make their working hours even more meaningful, by educating them on how to manage their personal finance better?

AMONG THE ORGANISATIONS WE HAVE COLLABORATED WITH

WHY CHOOSE OUR FINANCIAL LITERACY CORPORATE TRAINING AND SPEAKER?

Aisya Rahman Advisory, as an accredited Training Provider under HRD Corp, focuses on providing training modules and consultancy services to government and private entities. Our central aim is to contribute to the mission and vision of these organisations by integrating financial literacy into their operations. Our services extend to encompass various aspects of financial literacy within organisational contexts.

Investing in financial literacy corporate training and speaker is an investment in your company's future. Here are just a few benefits:

- Reduced absenteeism and turnover: Financially secure employees are less likely to miss work or leave for financial reasons.

- Improved employee morale and engagement: When employees feel empowered and supported, they are more engaged and productive.

- Enhanced employer brand: Your commitment to employee well-being attracts and retains top talent.

- Boosted corporate social responsibility: Investing in financial education demonstrates your commitment to social good.

OUR TRAINING COURSE OUTLINE:

- Develop budgeting skills

- Learn debt management

- Knowing the right type of protection via insurance and takaful

- Navigate Investment strategies

- Planning for one’s hereafter

- Plan for retirement

- Achieve financial security

- Achieve financial peace of mind and boost overall well-being

- Enhance financial literacy

- Understand and improve credit scores

- Understand the impact of inflation on finances

WHAT'S IN IT FOR YOU; THE EMPLOYER?

Financial literacy corporate training and speaker:

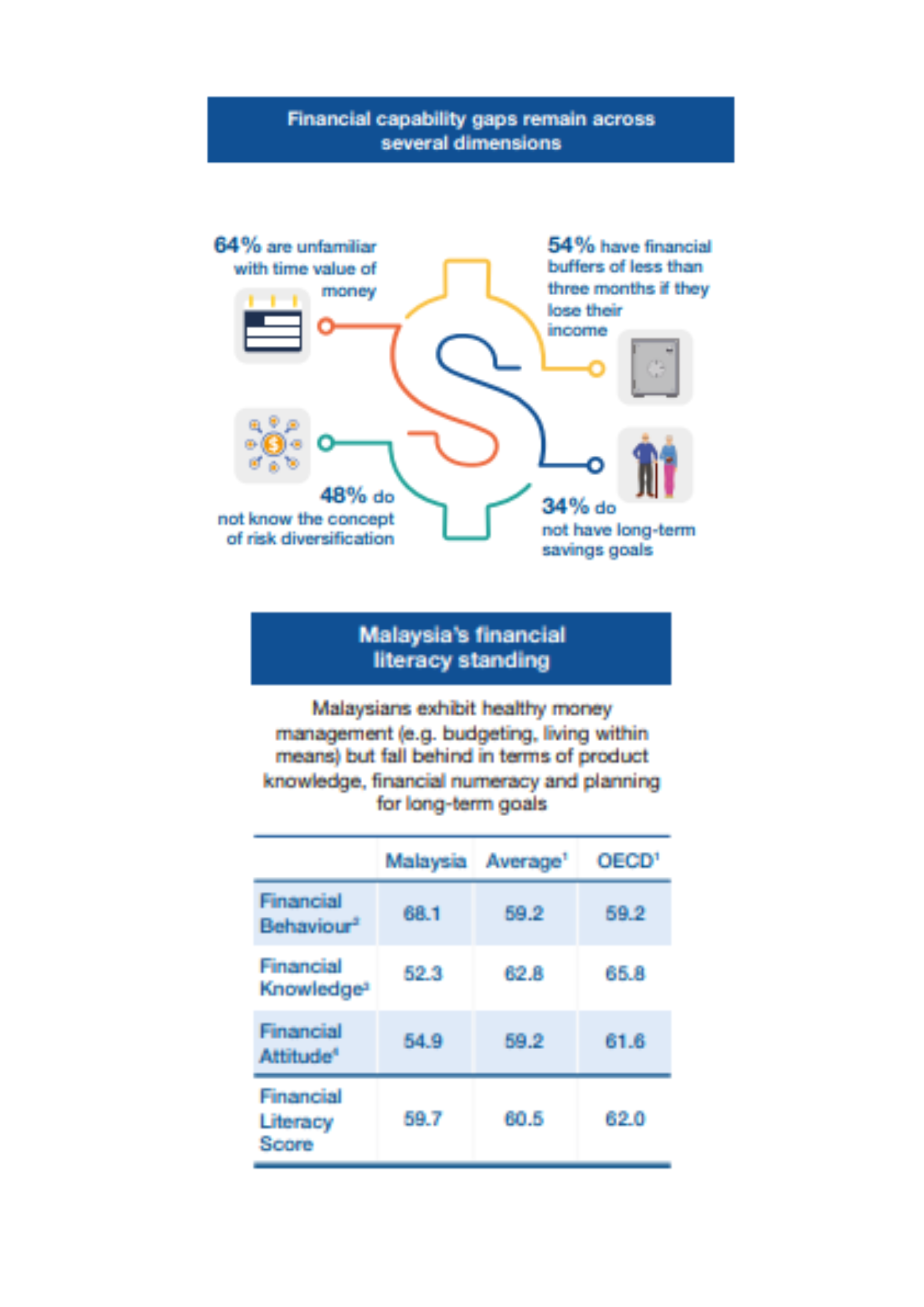

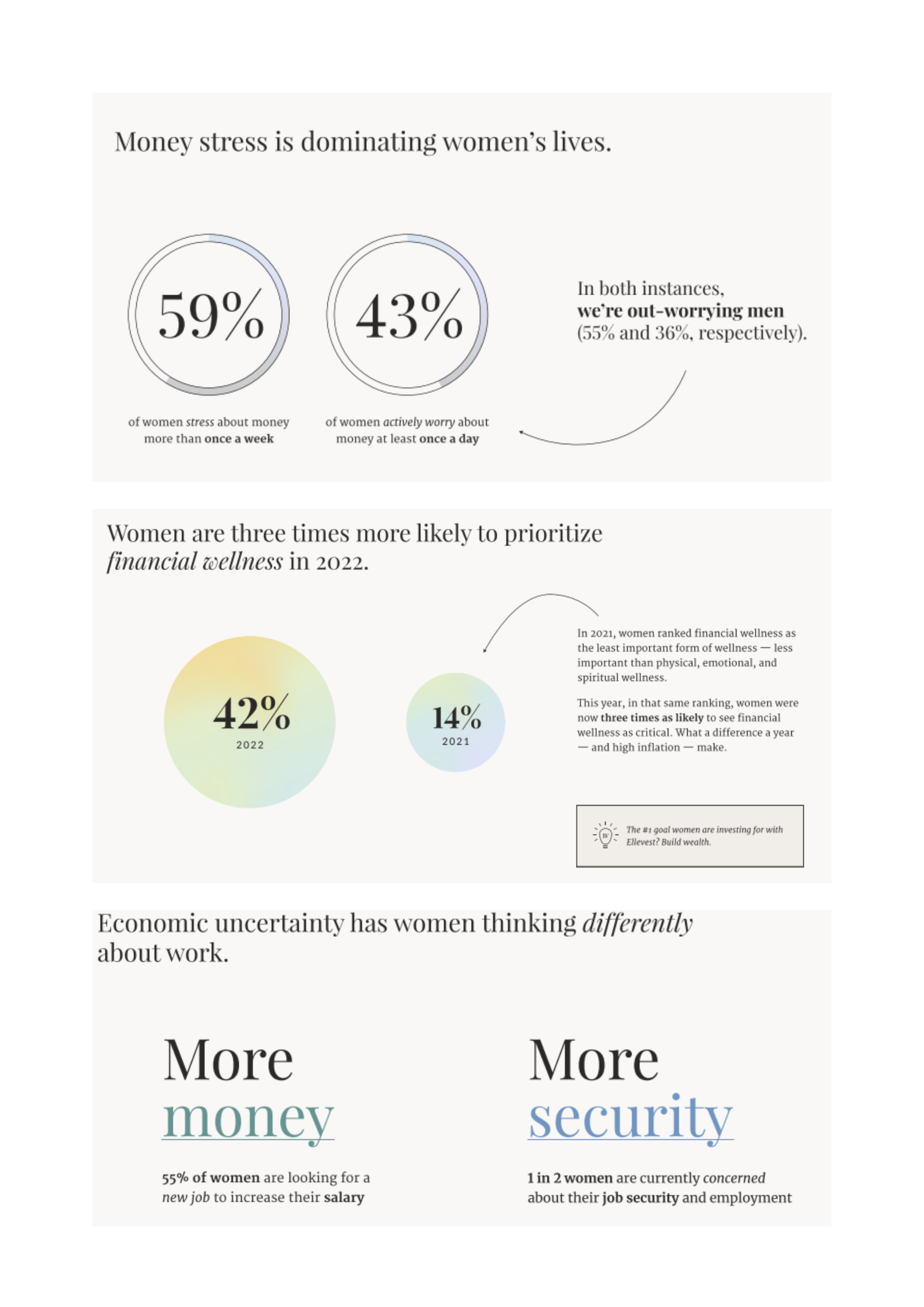

Never underestimate the impact that you could create. This little effort of introducing financial literacy to your workforce and organisation can generate higher return on investment. Based on the following research, employees today yearn for a different kind of motivation – they want to work for an organisation that cares about their financial wellness too!

Once your team members understand the relationship between economic cycle and how it influences everything else including the performance of your organisation, they will be able to see the big picture and add value. Therefore, your return on investment goes beyond than just employees’ retention but also team members who finally know why costs need to be kept lean and redundancy in the organisation must be minimal.

THE TRAINING ORGANISED BY AISYA RAHMAN ADVISORY

- Individual

- Corporate, Individual, Start-up

- Women

- Brand Collaboration

- Brand Collaboration

- Training & Workshop, Women

- Training & Workshop, Women

- Training & Workshop, Women

- Brand Collaboration

- Corporate, Training & Workshop, Women

- Corporate, Kids

- Corporate

- Corporate

- Corporate, Training & Workshop

- Brand Collaboration, Women

- Brand Collaboration, Women

- Brand Collaboration

- Training & Workshop, Women

- Training & Workshop, Women

If you're part of Human Resource, Culture, Learning, People, or Talent Development and seeking a unique way to empower your team, we can customise financial literacy corporate training and speaker. The session includes a Q&A segment. Drop your details below to explore further.