So… Do you want FIRE, or freedom?

What Is Freedom… Really?

Freedom isn’t just about traveling the world, quitting a job, or hitting a certain number in the bank account.

Freedom is waking up without dread.

It’s the ability to say “no” to what drains energy and “yes” to what truly matters — whether that’s family, faith, health, or rest.

It’s having space to breathe. To pause. To choose.

Not because life is perfect, but because it’s intentional.

Freedom is being able to take a break when needed — without fear that bills will pile up.

It’s working on things that light a fire in the heart — not just because rent is due.

For some, freedom means scaling back. For others, it means building something bigger.

But for everyone, freedom means the same thing: choice.

What Is FIRE? (And Why It’s Not What Most People Think)

FIRE stands for Financial Independence, Retire Early.

It’s a global movement where people plan, save, and invest in a way that allows them to reach a point where work is optional, not mandatory.

But here’s the truth: FIRE isn’t just about early retirement.

FIRE is a framework for freedom.

It helps build a life where money becomes a tool, not a trap.

Where time becomes the most valuable asset — not something traded away for every paycheck.

Here’s what FIRE typically looks like:

✨ Tracking expenses intentionally — Being mindful of every ringgit that comes in and goes out. You know where your money is going and why, allowing you to cut unnecessary spending and align your finances with your values and goals.

💰 Saving and investing a large portion of income — Instead of spending every sen, you prioritise your future self. You consistently set aside money for savings and investments, understanding that small, smart decisions today can lead to massive growth tomorrow.

📈 Building passive income from investments — You create streams of income that don’t rely on your time or energy — whether through dividends, rental income, or other investments. This gives you more freedom and security as your money begins to work for you.

🌱 Reaching a point where work is a choice, not a necessity — Financial independence becomes your reality. You no longer work because you have to, but because you want to. Your finances support the life you choose — whether it’s travel, family, passion projects, or simply peace of mind.

A popular FIRE principle is the 25x Rule — if annual living expenses are RM60,000, then RM60,000 × 25 = RM1.5 million is the amount needed to safely “retire” with investments generating ongoing income.

But again — it’s not about quitting life.

It’s about owning it.

So… Do You Want FIRE? Or Freedom?

FIRE gives structure.

Freedom gives meaning.

Some chase FIRE like it’s a finish line. But freedom isn’t always about retiring early.

It could be:

- Paying off debts and breathing easier

- Having savings so a toxic job can be left without panic

- Taking a career break to raise children, recover, or rediscover purpose

- Working part-time, but living full-time

For some, full FIRE is the goal — total financial independence.

What matters is waking up and knowing:

- The bills are paid

- Time is respected

- Life feels lighter

That’s freedom.

The First Step Is a Simple Question

What does freedom look like for this life?

Not someone else’s version. Not social media’s highlight reel.

But a real, grounded version that feels honest and good.

Start there.

Then plan backwards.

Save with intention.

Invest with confidence.

Live with purpose.

Because chasing FIRE is powerful — but finding freedom in the process is where the real magic happens.

Fear or Scarcity: Why Are Women Afraid of Money

A personal finance for women in Malaysia.

Too many women, even high achievers, let fear and scarcity thinking control their financial decisions. Whether it’s delaying investments, avoiding money conversations, or simply “letting someone else handle it,” the cost is real.

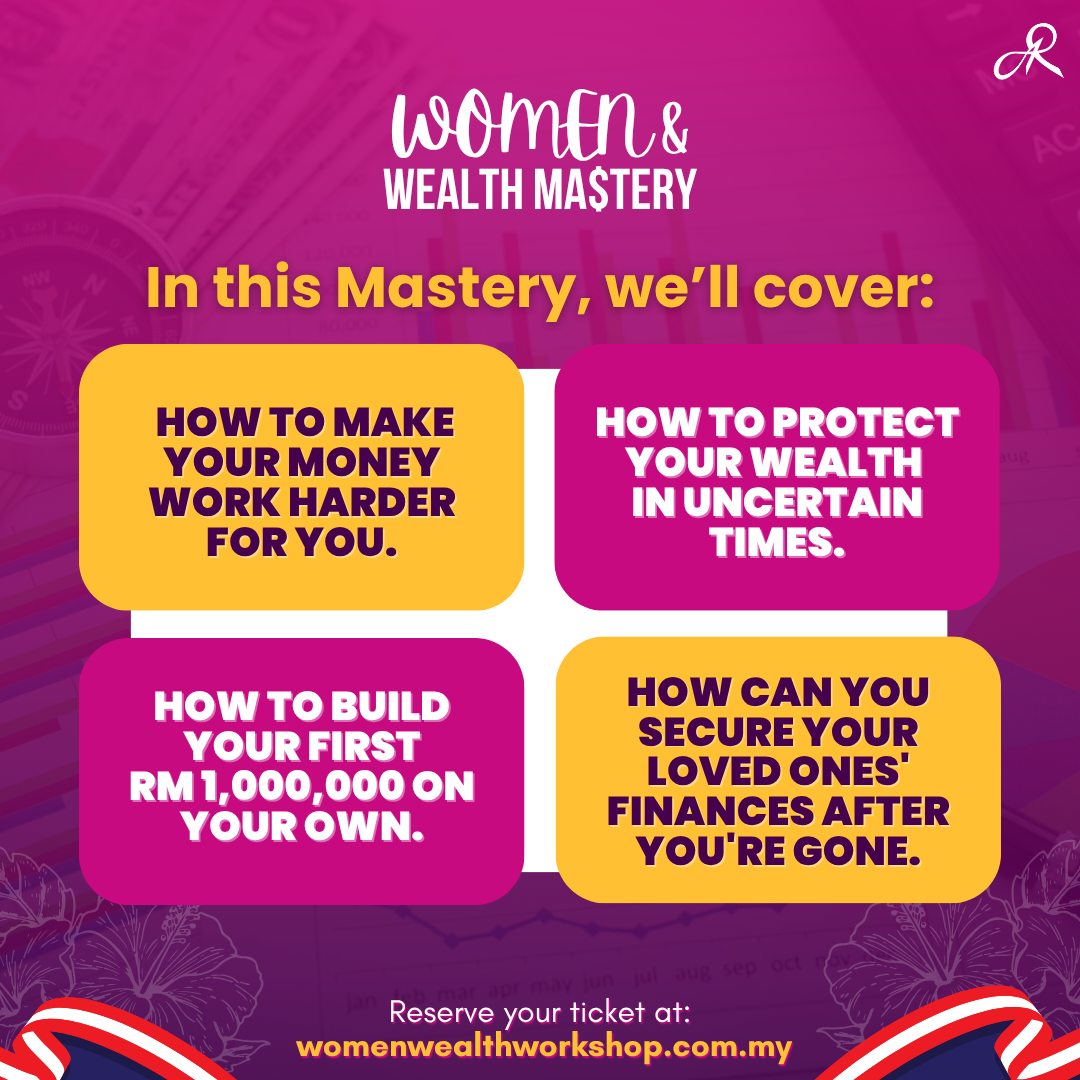

At Women & Wealth Mastery, we’re here to change that.

You’ll learn:

Choose your date:

-

20 September 2025 — Specially for women in government, oil & gas, and healthcare

-

21 September 2025 — Open to all women in Malaysia

This isn’t just a financial class.

It’s the first step to a freer, more intentional life.

🎟 Seats are limited — Secure yours now at womenwealthworkshop.com.my

For those seeking guidance on a more profound journey towards financial independence and lasting impact, our eBook, offers strategies to enhance your approach. Turning your wealth into good is not simply an act; it is a commitment. It is a powerful declaration that with wealth comes responsibility, and with compassion comes change.

Stop letting fear dictate your financial future.

Start building the freedom you deserve.