Scarcity vs strategy is more than just a financial concept. It’s a powerful reflection of how your mindset shapes your money habits.

Have you ever checked your bank account and thought, “Where did all my money go?”

You might be earning a good income possibly even more than many around you but somehow, true financial control still feels out of reach.

That’s not always about how much you earn. It’s often about how you think.

Let’s break down what scarcity vs strategy really means and why understanding the difference can transform your finances.

Understanding the Scarcity Mindset

In the scarcity vs strategy conversation, scarcity is the mindset rooted in fear.

It’s the fear of not having enough, missing out, or being unprepared.

This fear creates a sense of urgency that leads to impulsive financial decisions, buying things on sale just because they’re on sale, or overspending when a paycheck lands.

You might find yourself:

- Jumping on sales even if you don’t need anything.

- Buying items in bulk “just in case.”

- Feeling anxious when money leaves your account—even for planned expenses.

- Avoiding your bank statements or budgeting apps altogether.

- Comparing your spending habits or lifestyle to others and feeling behind.

The irony is that people with a scarcity mindset often spend more, not less. Why? Because decisions are made emotionally, not strategically. It’s not about what’s needed—it’s about trying to quiet that inner fear of lack.

This kind of thinking isn’t limited to people with lower incomes. Even high earners can struggle with it. When you’ve grown up around financial instability or internalized messages about “never having enough,” it sticks. And until it’s addressed, it can sabotage even the best financial intentions.

What Does a Strategy Mindset Look Like?

The second part of scarcity vs strategy is the strategy mindset.

This mindset is all about clarity, intention, and control. Rather than reacting out of fear, you act with purpose. It’s not about deprivation, it’s about direction.

Signs you’re working from a strategy mindset:

- You know where your money goes each month.

- You track your spending and check your progress regularly.

- You make purchases based on value, not pressure.

- You plan for both your goals and emergencies.

- You invest with purpose and patience—not just “good feelings” or trends.

In the scarcity vs strategy dynamic, strategy is the mindset that empowers you. It turns money into a tool not a source of stress.

Scarcity vs Strategy: Why It Matters

Understanding the difference between scarcity vs strategy is more than just a mindset shift—it’s a game-changer for your financial health.

Scarcity keeps you stuck in a reactive loop, where every decision feels urgent and overwhelming.

Strategy helps you step back, breathe, and make decisions that serve your bigger picture.

And the good news? You don’t need to earn more to make the shift from scarcity to strategy.

It starts with awareness and intention—not income.

A Simple Self-Check Before You Spend

Before your next big purchase or even a small one, try this quick exercise:

- Why am I buying this?

Is it because I truly need or value it, or because I’m feeling pressured or emotional? - Does this align with my bigger financial goals?

Will this purchase bring me closer to what I want, or pull me further away? - What would happen if I didn’t buy this today?

Would I regret it tomorrow—or even remember it next week?

You don’t have to overanalyze every ringgit.

But taking just 30 seconds to pause can prevent a lot of financial stress and regret down the line.

How to Shift from Scarcity to Strategy

You don’t have to overhaul your life overnight. Shifting from scarcity to strategy starts with small, practical steps:

- Track your spending for a month, just to observe your habits.

- Set one clear financial goal, like building a small emergency fund or saving for something specific.

- Create a budget that reflects your values, not just fixed categories. Love travel or books? Make room for them.

- Practice gratitude. It’s harder to feel scarcity when you’re regularly acknowledging what you already have.

Over time, these habits rewire your thinking. You’ll start making choices from a place of strength rather than fear.

Final Thoughts on Scarcity vs Strategy

Scarcity vs strategy is more than a financial comparison—it’s a mindset transformation. Scarcity says, “There’s never enough.” Strategy says, “Let’s make a plan.”

Money isn’t just about math. It’s about mindset. You can’t control every outside factor—like the economy or emergencies—but you can control how you respond. You can choose to approach money with fear or with purpose.

When you embrace the strategy mindset, you’re no longer just surviving—you’re building something meaningful.

So next time you’re faced with a money decision, remember this:

“Scarcity reacts. Strategy responds.”

And that simple shift can change everything.

Ready to Take Control of Your Finances and Start Earning Real Income?

If you’ve been feeling stuck in a cycle of financial uncertainty or scarcity, it’s time to change the story.

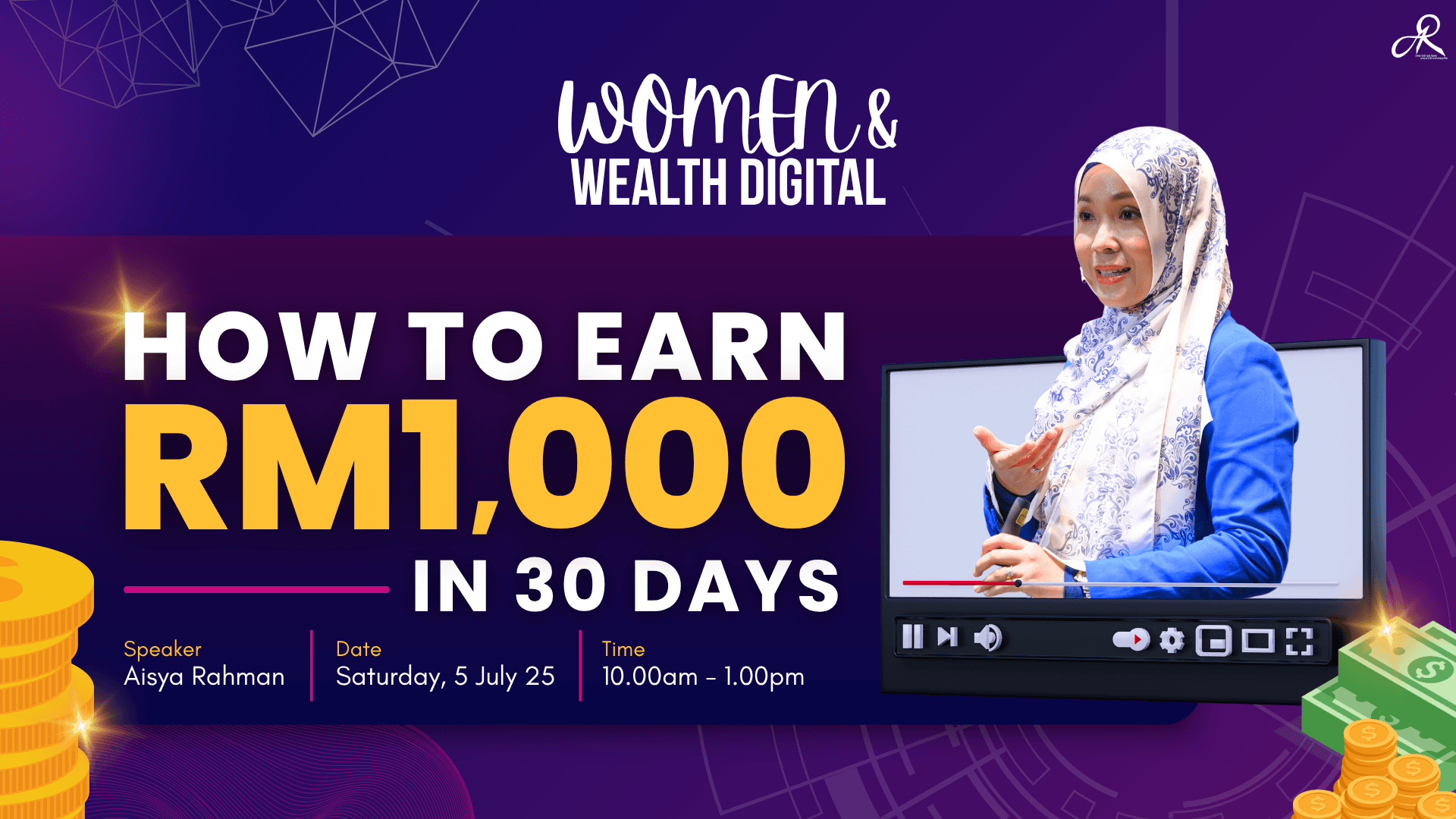

Join our Women & Wealth Digital Masterclass — a powerful, in-depth webinar designed to teach you how to earn RM1,000 in just 30 days using practical, actionable strategies tailored for women who want real results.

Event Details:

📅 Date: 5 July

⏰ Time: 10 AM – 1 PM

🌐 Reserve your spot now at: womenwealthworkshop.com.my

Spaces are limited, so don’t miss out on this opportunity to learn how to create new income streams and build financial security.

Whether you’re a beginner or looking to level up your current efforts, this masterclass will give you the clarity and confidence to take charge of your money.

For those seeking guidance on a more profound journey towards financial independence and lasting impact, our eBook, offers strategies to enhance your approach. Turning your wealth into good is not simply an act; it is a commitment. It is a powerful declaration that with wealth comes responsibility, and with compassion comes change.