“She got the house. I got a headache.”

It’s a story we hear too often, siblings arguing, families torn apart, and long court battles over who gets what. Inheritance disputes are emotionally draining, financially expensive, and, most of the time, completely avoidable.

So the real question is: Why waste time and money fighting over assets when there’s a smarter way?

What’s at Stake in an Inheritance Dispute?

When a loved one passes away without a clear plan, confusion and assumptions take over. This creates a perfect storm for conflict—and what’s at stake is often far more than just money.

- Time

Court cases over inheritance can drag on for months or even years. What starts as a simple disagreement over a house, land, or car can snowball into a lengthy legal battle that delays everything, including closure for the grieving family.

- Money

Lawyer fees, court filings, and document processing can cost thousands. Some families spend RM20,000-RM50,000 just to fight over land worth less than that. And let’s not forget—during that time, no one can sell, rent, or develop the asset.

- Relationships

This is the most heartbreaking cost. Siblings stop talking, cousins become strangers, and deep emotional wounds surface—often never to heal. Parents who spent their lives building a legacy never imagined it would become the reason their children drift apart.

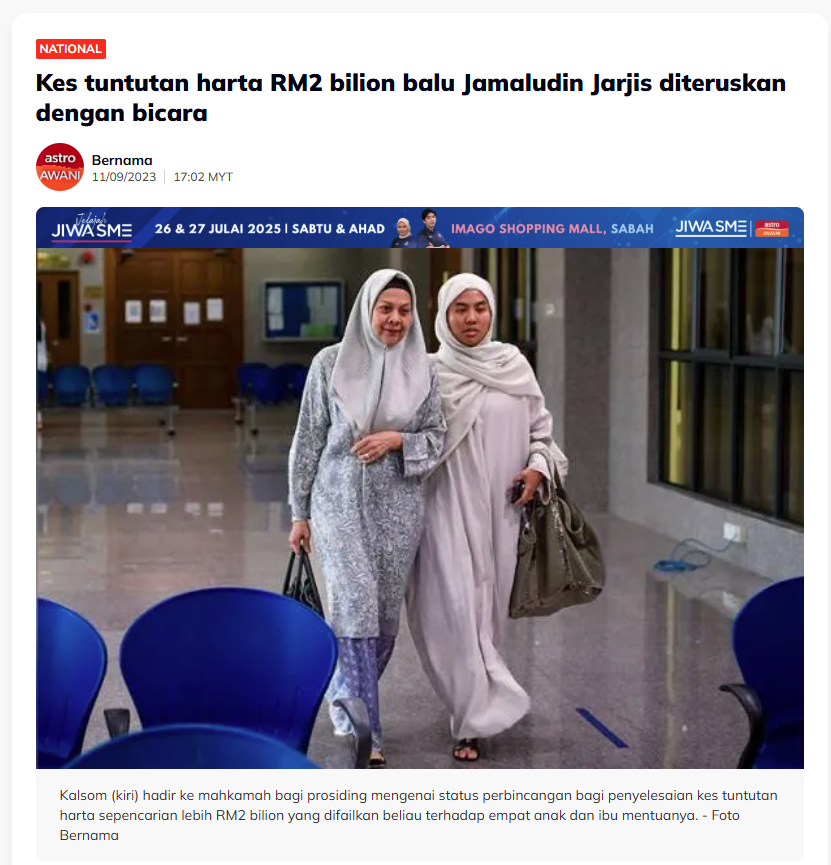

Source: Astro Awani

Why Do Families Fight Over Assets?

Fighting over inheritance usually doesn’t come out of nowhere. These are some of the common triggers behind family feuds:

🔸 No Will or Wasiat

Many families just assume things will be “settled naturally” or “ikut Faraid.” But when there’s no written instruction, confusion takes over. Verbal promises are not enough in court.

Source: Berita Harian

🔸 Misunderstood Faraid Distribution

Many assume Faraid means “equal” division—but it doesn’t. Sons receive more than daughters. If it’s not explained clearly in advance, this can cause frustration or confusion among heirs.

🔸 Verbal Promises with No Proof

“Arwah ayah cakap tanah ni untuk abang.”

But was it written down? Without documentation like hibah, verbal agreements can’t be enforced—and often lead to court disputes.

🔸 Hidden Resentments

Sometimes the fight isn’t really about the money—it’s about years of feeling “less loved,” “less appreciated,” or “always being compared.” The inheritance becomes a symbol of all that pain.

So What’s the Smarter Way?

Here’s what every Malaysian family should do—before it’s too late:

✅ Have The Conversation Early

Parents: don’t assume your children will “redha.” Talk to them. Explain your intentions. If you plan to give one child more (e.g., due to caregiving or past contributions), explain why.

✅ Write a Wasiat or Will

Whether Muslim or non-Muslim, having a written will or wasiat ensures your wishes are followed. For Muslims, use tools like hibah to gift assets while alive and avoid future court fights.

✅ Fair Doesn’t Always Mean Equal

In Malaysian culture, we often confuse “adil” with “sama rata.” If one child received education support overseas, and another stayed to care for parents, your distribution should reflect that.

✅ Get Professional Help

Speak to a Licensed Financial Planner or estate planning advisor who understands both Malaysian laws and cultural nuances. They can help structure your estate with hibah amanah, insurance nomination, trust accounts, and more.

Your Legacy Should Be a Blessing, Not a Burden

You worked hard to build your wealth. The last thing you want is for it to become a source of fitnah and family feud.

Even if your estate isn’t worth millions, estate planning brings peace of mind. No court letters. No family fights. No regret.

Want to learn how to manage your wealth for both this life and the hereafter?

Join our Women & Wealth Mastery designed to help you protect your legacy, avoid family conflict, and gain peace of mind.

Join our in-person class:

What you’ll learn.:

👉 Reserve your seat now at womenwealthworkshop.com.my/10287

Seats are limited, grab now!

For those seeking guidance on a more profound journey towards financial independence and lasting impact, our eBook, offers strategies to enhance your approach. Turning your wealth into good is not simply an act; it is a commitment. It is a powerful declaration that with wealth comes responsibility, and with compassion comes change.