Let’s be honest.

Tax season in Malaysia comes every year, but a lot of people still pretend it doesn’t exist. Ada yang “nanti lah”, ada yang buat tak nampak, ada yang terus panic mode, and some just hope everything magically settles itself.

For many Malaysians, tax is like that unread message you keep swiping away. You know you should open it. You know it will not disappear. But you still hesitate because deep down, you’re scared of what you might see.

And that is completely normal.

What most people don’t realise is this: the system is not designed to punish you. It is actually designed to help you pay the right amount, at a level that matches your lifestyle. Tax reliefs exist specifically to make that easier.

But before understanding reliefs, we have to understand why so many Malaysians avoid the topic altogether.

Why Malaysians Still Avoid Paying Tax

The first reason is fear. A lot of Malaysians takut tersalah. They imagine complicated forms, heavy penalties, and LHDN officers knocking on their door. Even if they earn enough to be taxable, their fear of “buat silap” is stronger than their confidence.

Another group of people believes they don’t earn enough to worry about taxes. They think, “I bukan high income pun.” But when they finally check their numbers, they realise their bonus, commission, or side income actually pushes them into the taxable range.

Then there are those who think PCB is the same as filing. Every month PCB kena potong, so they assume the story ends there. But filing is still needed to confirm your final numbers.

Some avoid filing because they imagine needing a whole lorry of receipts. They picture themselves flipping through old wallets, email inboxes, and crumpled papers. So they avoid it altogether.

The last group is the most relatable. These are the people who avoid filing because they takut tengok jumlah yang perlu dibayar. They think, “If I don’t open it, I don’t have to deal with it.”

But tax doesn’t work like that. Avoiding it doesn’t save you money. It only delays the stress.

The Real Consequences of Not Filing

Not filing tax doesn’t just cause legal problems. It creates everyday problems too.

You know that feeling when you want to apply for a house? The bank will ask for your tax documents. Suddenly, the stress creeps in. It’s not because you don’t qualify. It’s because you didn’t file.

Same thing when applying for car loans, business funding, even some government benefits. If your records are incomplete, everything becomes harder.

Then there’s the emotional side. Every year when tax season comes, you can feel that kecil pressure in your chest. You avoid emails from LHDN. You hope the date passes. But it doesn’t. The worry actually builds up over time.

And the worst part is the missed opportunities. Many people don’t know that when they file their taxes, the reliefs they claim can reduce the final amount so much that it feels lighter than they expected. Some even end up getting refunds.

That’s the part many Malaysians never experience because they never file.

How Tax Relief Actually Helps You

Tax relief is not just about “jimat tax”. It’s about making life easier.

Relief means your everyday expenses may already be working for you. Your lifestyle, your family responsibilities, your health needs, even your personal growth — these parts of your life often have reliefs tied to them.

Once Malaysians understand this, the fear of filing becomes smaller. Suddenly, tax filing doesn’t feel like a punishment. It becomes more like a yearly reflection of your financial life.

For example, when you understand reliefs, filing doesn’t feel like kena kejar anymore. You feel more in control. You understand why your number is what it is. You don’t panic when you click “Calculate”. You don’t feel attacked by the system.

And the best part is this.

When you understand relief, you will realise that tax is not something you handle at the end of the year. It’s something you naturally manage throughout the year because your expenses are already aligned with the relief framework.

Everything becomes clearer. And clearer means calmer.

Why Paying Tax Is Part of Growing Up Financially

Filing tax is actually one of the first signs that your financial life is moving forward. It means you’re earning. It means you’re building something. It means your life is progressing.

People who file their taxes consistently tend to be more organised with their money. They know where they stand. They understand their income. They keep track of their commitments. They make smarter decisions about savings, protection, and family planning.

And here’s the truth.

The more you understand your taxes, the more confident you feel about your financial future.

How to Make Tax Filing Less Stressful

Start by accepting that tax is part of adult life. Once you accept this, the fear gets smaller. Filing becomes just another routine — like renewing your road tax.

A simple habit can make a big difference. Keep receipts as you go. Not for everything. Just the important ones. Put them in one pouch, or take pictures and store them in a folder on your phone.

Another mindset shift is to stop thinking of tax filing as a test. It’s not an exam. There is no “perfect score”. It’s simply a yearly check-in with your financial life.

And if you really don’t know where to start, getting help does not make you weak. It shows that you’re taking responsibility.

Final Thoughts

Avoiding tax is something many Malaysians do out of fear or confusion. But running away from it only makes life harder. Filing tax, on the other hand, brings clarity. The more you understand relief, the lighter the process becomes.

Tax relief is not just a guideline. It’s a tool that helps you reduce stress, pay the right amount, and feel more in control of your money.

When you understand how relief works, you go from “takut” to “faham”.

You go from avoiding to taking charge.

And your entire financial life becomes calmer and more confident.

Join Us to Learn More: Women & Wealth Mastery

If you want a preview of how we guide women step-by-step in strengthening their financial foundation with the intention of becoming more prepared for all major life responsibilities, including Hajj, we invite you to join us:

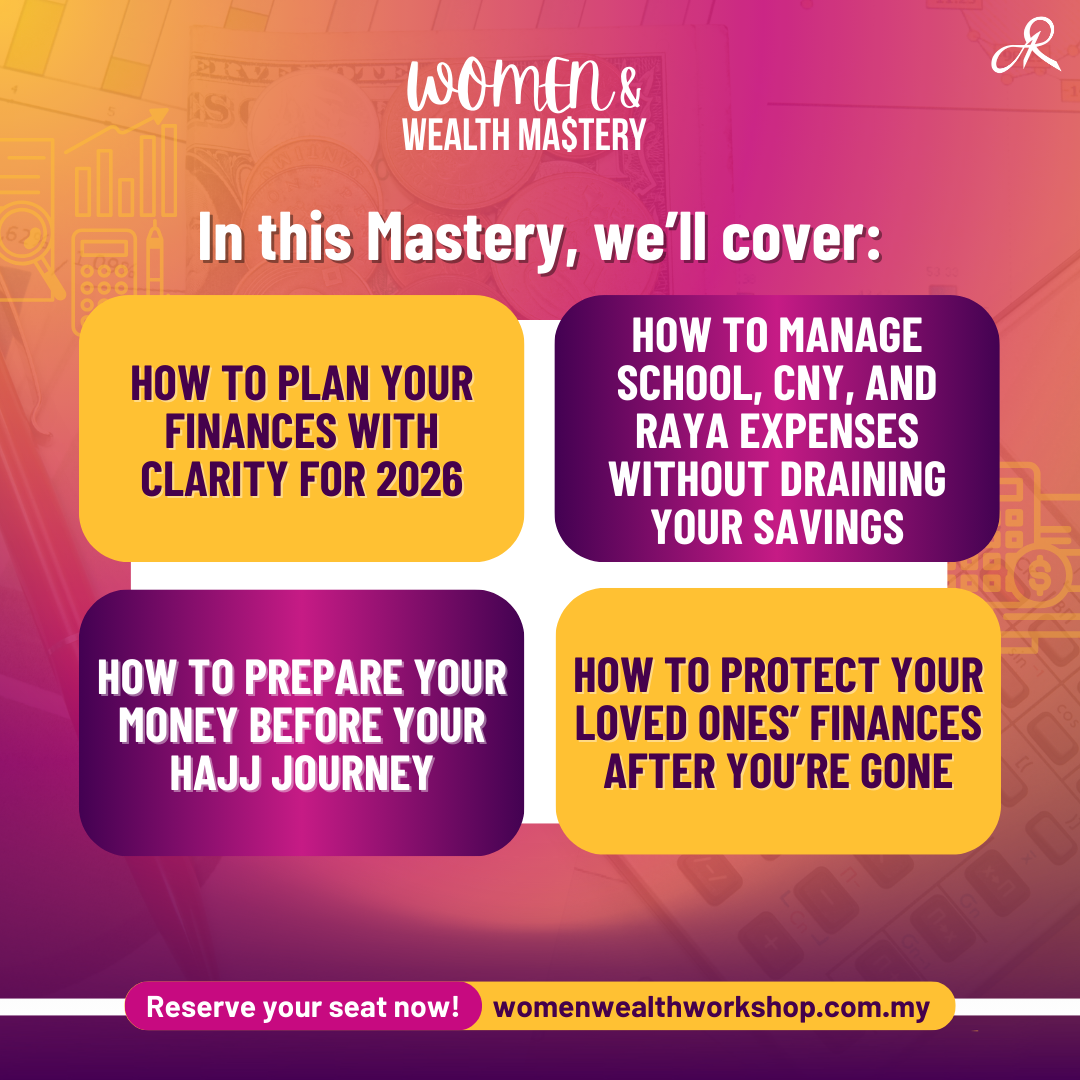

You will learn:

This is not a class that teaches Hajj rituals but rather a space where we help women strengthen their financial readiness, mindset, and long-term planning so they can honour all their responsibilities with ease.

Whether Hajj is part of your near plans or something you’re still thinking about, this session will show you how improving your financial strength makes every ibadah and life decision more accessible, structured, and peaceful.

Click here to join: womenwealthworkshop.com.my

A Final Reflection

As we step into another blessed Friday, take a moment to ask yourself:

“Is Hajj in your long-term plan, or is it something you quietly push aside?”

If it has been sitting at the back of your mind…

If it feels too far, too complicated, or too overwhelming…

Know that you’re not alone.

And you don’t have to figure it out on your own.

Women & Wealth Mentoring is here to guide you—not just to grow your income, but to fulfil your deeper responsibilities as a Muslim woman, with clarity, structure, and purpose.

Sending you love and strength all the way from Sepang 💜🤲🏻🕋

Want to Get Started Right Away?

Don’t wait for “someday” to take charge of your finances or your child’s future.

Download our FREE eBook now and start your journey toward financial clarity and purposeful planning today.